Arthur Heilbronn has all the traits of being groomed to wield power over one of the world’s biggest multi-generational fortunes.

Deep family connections? Check. Ivy League degree? Check. Wall Street smarts? Check.

Now there are growing signs the scion from the dynasty behind the Chanel empire is moving closer to the top of the firm, overseeing its $90 billion fortune.

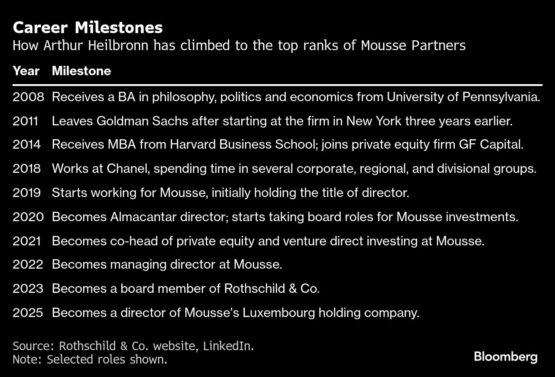

Heilbronn, 38, has taken on management positions overseeing his and his relatives’ real estate, banking and media investments in the six years since joining Mousse Partners, one of the world’s largest and most discreet family offices. In the latest indication of ascent for the Harvard Business School graduate and ex-Goldman Sachs banker, he became a director earlier this year for one of Mousse’s main holding entities, occupying a role vacated following the death of longtime Chanel executive Michael Rena, according to registry filings.

He’s also the son of Charles Heilbronn, founder of Mousse and the firm’s chairman since 1991. Charles is a half brother of Alain and Gerard Wertheimer, third-generation heirs to the Chanel fortune.

The Wertheimers are grandsons of one of the original business partners of Gabrielle “Coco” Chanel who started the fashion house in 1910. They shared the same mother as Charles, Eliane Heilbronn, who was considered the empire’s matriarch until she died last year. Her sons are all in their 70s.

A representative for Mousse declined to comment.

The Wertheimers, credited with owning equal shares of closely-held Chanel, each have a net worth of about $45 billion, according to the Bloomberg Billionaires Index. Their fortune has largely held up in the post-pandemic era, even as a downturn in luxury goods hit rivals including LVMH, led by Bernard Arnault, and Kering SA, controlled by the Pinault family.

Arthur Heilbronn’s rise gives some indication of the succession plans of the media-shy extended family, which has long sought to keep its wealth out of the public eye. Gerard Wertheimer’s son David has started a private equity venture, though there’s no indication that other children of the two heirs are involved with Mousse.

ADVERTISEMENT

CONTINUE READING BELOW

“They feel less like a family office and more like a private endowment for a luxury empire,” Marc Debois, founder of FO-Next, an advisory firm for family offices, said of Mousse. Among its peers, “what puts them in the true top 1% isn’t size; it’s time; dividend-fed, multi-cycle patience.”

At least one-fifth of individuals among the world’s 500 biggest fortunes now have a family office that help to oversee wealth totaling more than $4 trillion, according to the Bloomberg Billionaires Index.

A recent survey of 317 family office clients at UBS Group AG found just over half of them have a succession plan in place, with those in the US and Southeast Asia most likely to have made those arrangements.

“It’s a huge topic,” Eric Landolt, UBS Group AG’s global head of family advisory, said on succession plans for family offices. “It’s something that comes up in almost every discussion.”

Heilbronn joined Mousse as a director in 2019, moving to managing director a few years later, according to his LinkedIn profile. He’s currently co-head of private equity and venture direct investing with another managing director, Paul Yun. He was named to the supervisory board of Rothschild & Co. after Mousse Partners made one of its most high-profile investments to date by joining two other French dynasties in 2023 to help take the bank private. He’s also a director of Almacantar, a London-based real estate firm behind large-scale projects in the English capital.

Chanel’s ultimate holding company is the Wertheimers’ Cayman Islands-based Mousse Investments Ltd., which doesn’t reveal financial numbers. Mousse Partners is the investment division and also has offices in Beijing and Hong Kong.

Mousse Investments describes itself as having a “broad range of asset classes in public and private markets” in addition to Chanel. While Mousse doesn’t disclose how much money it controls, some companies have named Mousse Partners as a participant in deals or as a shareholder. That points to investments in stocks, real estate, credit and private equity.

ADVERTISEMENT:

CONTINUE READING BELOW

Mousse Partners employs more than three dozen people worldwide and counts former banking analysts from JPMorgan Chase & Co. and Wells Fargo & Co. among its employees. Suzi Kwon Cohen joined as chief investment officer almost a decade ago after leading North America private equity for Singapore’s sovereign wealth fund, putting her among the top female executives in the historically male-dominated family office space.

Over the years, Mousse Partners has backed a wide range of startups including mental health provider Brightside Health, digital advertising firm Brandtech Group, biotechnology company Evolved by Nature, food company Harmless Harvest and health-care provider Thirty Madison. Last year Mousse joined the billionaire L’Oreal SA heiress investing in high-end clothing brand The Row.

Not all bets have proved lucrative. Beautycounter failed last year while a pair of Mousse’s public holdings are languishing. The family office has a roughly 8% stake in listed French digital entertainment company NetGem SA and 5.7% in hair products maker Olaplex Holdings Inc. Both companies’ share prices collapsed from their initial public offering levels and haven’t recovered.

Mousse has also been invested for decades in France’s publishing and audiovisual industry through Media-Participations, which owns a range of book publishing, specialized media, cartoon and comic businesses.

The family behind Chanel, a maker of $970 sunglasses, $6,500 handbags and $23,400 J12 watches, has joined other French luxury billionaires with media holdings at home. Bernard Arnault owns newspapers Les Echos and Le Parisien along with the glossy weekly Paris Match. The Pinault clan owns magazines Le Point and Point de Vue.

While Mousse isn’t involved in Chanel’s operations, both companies have offices in a glass tower just south of Central Park in Manhattan that’s famed for its pricey rents and list of major financial tenants. Both Arthur and Charles Heilbronn listed their workplace address at that New York premises on Manhattan’s “Billionaires Row,” where Alain Wertheimer has also long-held an office.

Behind closed doors on that street, the next steps in the succession plans for Mousse Partners may already be taking shape, though it’s unlikely anyone in the dynasty behind Chanel will comment publicly on the matter.

“We’re a very discreet family,” Gerard Wertheimer once said in 2001. “We never talk.”

© 2025 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

5 hours ago

1

5 hours ago

1

English (US) ·

English (US) ·