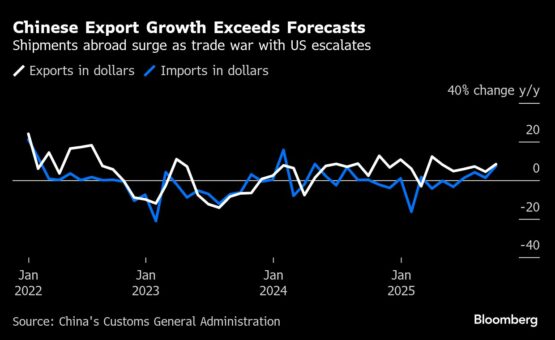

Chinese shipments overseas grew at the fastest in six months, far exceeding forecasts in a sign of resilience that’s giving Beijing a stronger hand in the latest trade war with the US.

Exports rose 8.3% in September from a year earlier to $328.6 billion, the biggest monthly total so far in 2025, according to data from the General Administration of Customs on Monday. That was faster than the 6.6% median estimate in a Bloomberg survey of economists and shows there’s no slowdown yet in the record-breaking flood of goods leaving China’s shores.Shipments to the US plunged 27% — the sixth month of double-digit declines — a slump more than offset by strong growth in sales to regions like the European Union. In total, exports to non-US destinations grew 14.8%, the fastest since March 2023.“China’s exports have remained resilient despite US tariffs, thanks to a diversified export market and strong competitiveness,” said Michelle Lam, Greater China economist at Societe Generale SA. “The limited impact from US tariffs on overall trade so far has likely emboldened China to take a tougher stance in US-China trade negotiations.”

ADVERTISEMENT

CONTINUE READING BELOW

The strength of demand from markets other than the US means that Chinese firms should be less affected by the further increase in tariffs threatened by President Donald Trump. Higher sales overseas are also providing a boost to a domestic economy in deflation and still struggling to reverse a decline in housing demand and prices.

China is set to announce third-quarter data for economic activity on Oct. 20, with most analysts predicting a slowdown from the first half of the year. Still, a strong showing in the first two quarters put China on track to reach the official growth target of around 5%.

Companies have responded to higher US tariffs by trying to seek out alternative markets or routing goods indirectly to the world’s biggest economy. Shipments to Africa surged 56% last month — the fastest since February 2021 — with exports to Latin America rebounding 15.2% from declines in June and August.

Exports to the EU rose by more than 14%, the most in over three years, and those to the 10-nation Southeast Asian trading bloc grew almost 16%.

Vietnam was among major trade partners seeing the biggest increases, with China’s exports there jumping almost 25% even as growth moderated. Capital Economics called Vietnam “the top rerouting hub” and said the latest figures suggested “rerouting remains a key offset against US tariffs.”

Imports grew 7.4% in September, far more than forecast, as China increased purchases from countries like Japan, South Korea, the Netherlands and Taiwan. That brought China’s overall trade surplus to $90.5 billion — an almost 11% rise from the same month in 2024.

ADVERTISEMENT:

CONTINUE READING BELOW

And as China holds back from buying American goods like soybeans, its trade surplus with the US actually widened slightly from August to nearly $23 billion in September. China’s exports to the EU exceeded its imports by almost $23 billion, resulting in the smallest trade surplus with the bloc since March.

“The current external environment remains grim and complex,” Wang Jun, deputy head of the customs authority, told reporters in Beijing. “Foreign trade faces rising uncertainty and difficulties. Taking into consideration a high base from last year, we need hard work to stabilise trade development in the fourth quarter.”

China unveiled wide-ranging global export controls on products containing even traces of certain rare earths last week, prompting Trump to fire back by threatening to cancel a planned in-person meeting with President Xi Jinping — their first in six years. The US leader also announced plans to put an additional 100% tariff on Chinese goods, along with sweeping curbs on “any and all critical software.”

The Trump administration later signalled openness to a deal with China to quell fresh trade tensions while also warning that recent export controls announced by Beijing were a major barrier to talks.

Last month, Treasury Secretary Scott Bessent said the two sides would hold another round of talks in Frankfurt, Germany, before the Nov. 10 expiration date for the tariff trade truce.

Bloomberg Economics estimates that a 100% US tariff hike would lift effective rates on Chinese goods to around 140% — a level that shuts down trade. While the current rate is 25 percentage points above the world average, China’s dominance of manufacturing has kept its exports flowing.

But the limited exposure to the US of China’s fastest-growing exports — ranging from lithium batteries to ships and electric vehicles — should make it easier for Beijing to contain any further disruption in trade, according to Lynn Song, chief Greater China economist at ING Bank NV.

“So far this year, China has shown that while it does not wish for a trade war, it is willing to retaliate to escalations as needed,” he said. “The export resilience will likely strengthen confidence in this approach ahead of the talks later this month.”

© 2025 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

4 days ago

1

4 days ago

1

English (US) ·

English (US) ·