CMS Energy prices $850M convertible notes offering

4 hours ago

1

4 hours ago

1

Related

Toyota Motor Q2 Earnings Preview

6 minutes ago

0

SkyWater Technology Q3 2025 Earnings Preview

6 minutes ago

0

SiTime Q3 2025 Earnings Preview

7 minutes ago

0

Southwest Gas Q3 2025 Earnings Preview

7 minutes ago

0

MKS Instruments Q3 2025 Earnings Preview

8 minutes ago

0

Brookfield Renewable Q3 2025 Earnings Preview

8 minutes ago

0

Qualcomm Q3 Preview: Handset chip sales in focus

9 minutes ago

0

Rheinmetall begins building ammunition plant in Lithuania

11 minutes ago

0

Sempra Q3 2025 Earnings Preview

11 minutes ago

0

Fastly Q3 2025 Earnings Preview

18 minutes ago

0

YPF, Eni sign framework deal with ADNOC's XRG to develop Arg...

18 minutes ago

0

frontdoor Q3 2025 Earnings Preview

20 minutes ago

0

Choice Hotels Q3 2025 Earnings Preview

21 minutes ago

0

CME Group October ADV hits record 26.3M contracts, up 8% Y/Y...

22 minutes ago

0

Anywhere Real Estate signals Compass merger and suspends gui...

22 minutes ago

0

National Vision Holdings Q3 2025 Earnings Preview

26 minutes ago

0

Neonode Q3 2025 Earnings Preview

28 minutes ago

0

Lucid to announce Q3 results as investors watch guidance and...

34 minutes ago

0

MCD’s same-store sales, digital loyalty program in focus dur...

34 minutes ago

0

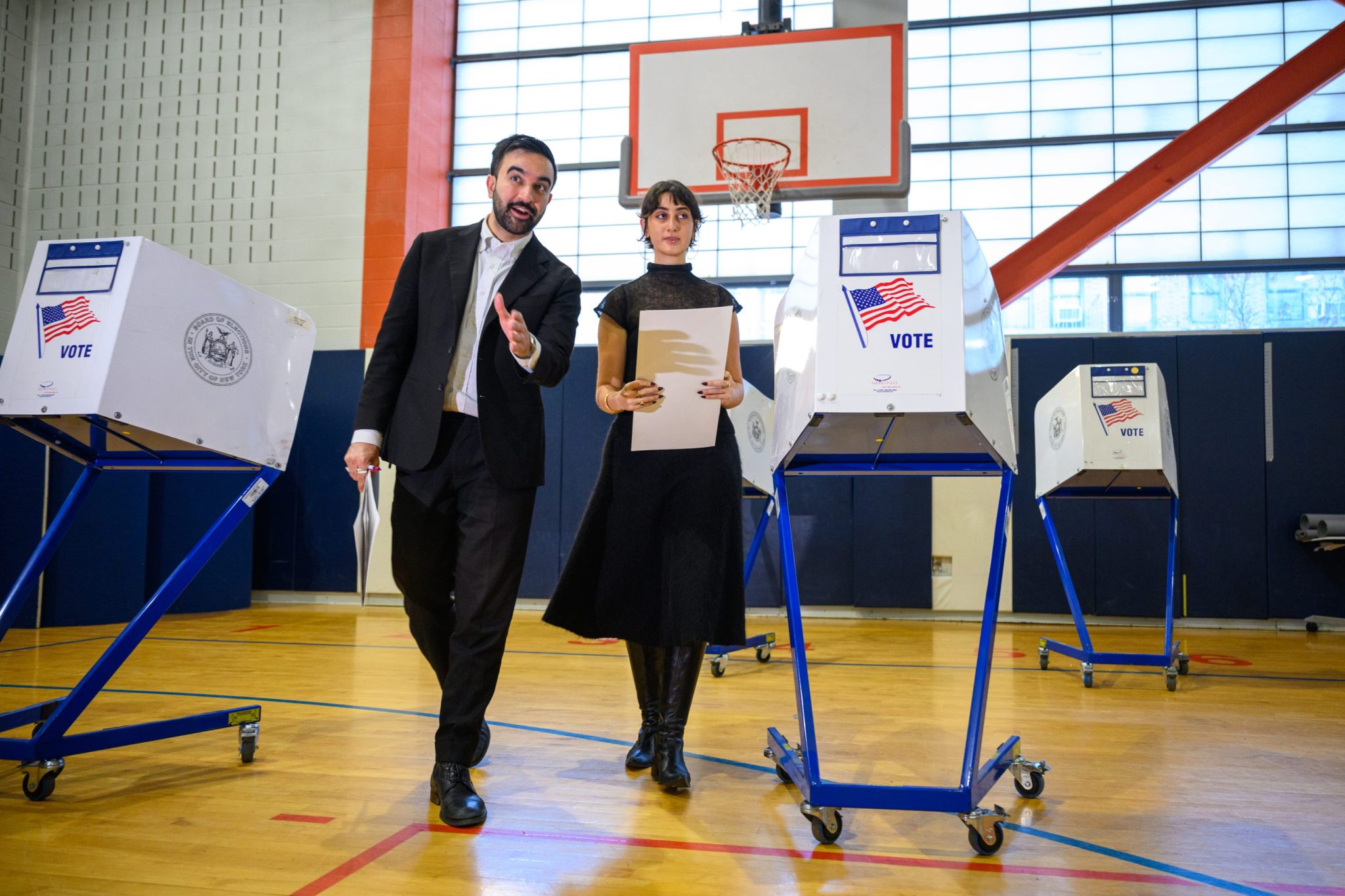

New York’s mayoral race becomes a national test of economic ...

34 minutes ago

0

Trending

Popular

© FBT Company 2025. All rights are reserved

English (US) ·

English (US) ·