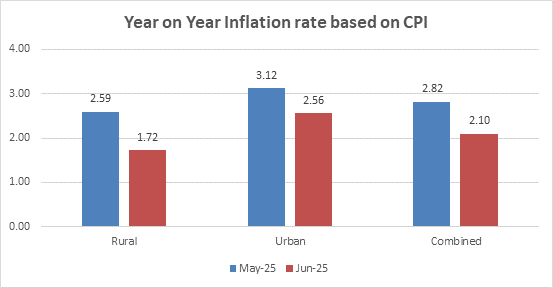

Domestic consumer inflation eased to 2.10 per cent in June, easing from 2.82 per cent in the previous month, according to official data released on Monday. This marks an eighth straight month of sequential easing in consumer inflation--also known as retail inflation. Measured with the Consumer Price Index (CPI), consumer inflation captures the rate of increase in the prices of select goods and services in the country, such as food, fuel and electricity.

Inflation in rural and urban parts of the country also eased to 1.72 per cent and 2.56 per cent in June, from 2.59 per cent and 3.12 per cent in May, respectively, the data showed.

Overall as well as rural and urban inflation eased sequentially in June. | Source: Ministry of Statistics & Programme Implementation (MOSPI)

The Reserve Bank of India (RBI) tracks consumer inflation data closely to formulate its monetary policy.

In its last bi-monthly review, the RBI Governor-chaired Monetary Policy Committee decided to cut the repo rate--or the key interest rate at which the central bank lends money to commercial banks--by a larger-than-expected 50 basis points (bps), as cooling inflation allowed room for supporting growth amid global economic volatility.

The MPC, however, switched back to a 'neutral' stance of policy from 'accommodative', reversing a change brought about in the previous review in April.

The RBI's MPC conducts six bi-monthly reviews every year, and any additional reviews during economic emergencies.

2 hours ago

1

2 hours ago

1

English (US) ·

English (US) ·