The start of Donald Trump’s second presidency has matched his first term in proving a boon for emerging-market stocks, but the rally risks running out of steam given his trade and fiscal policies are also sinking corporate earnings.

The benchmark MSCI Emerging Markets Index has posted an advance every month from January through August this year, the first of Trump’s second term. That’s happened only twice before in the 37 years that investors have tracked emerging markets as an asset class: in 2017, also a Trump inaugural year, and in 1993, under Bill Clinton.

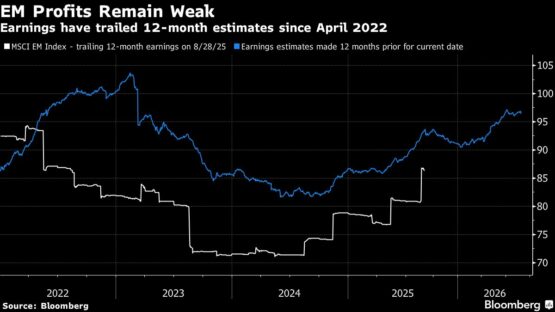

But the Trump bump hides a fact that should worry investors in emerging-markets stocks, who’ve seen their wealth increase by $4.3 trillion so far this year: companies in developing nations are hurting. They’ve failed to meet expectations for profits in 2025, and, on average, are trailing projections for a 13th successive quarter. Earnings projections have also begun to fall, indicating the pain is set to deepen.

The contrasting trends in stock-market performance and corporate earnings are both driven by Trump’s policies. His disruptive tariffs and fiscal expansionism have reduced the US dollar’s haven appeal, driving a hunt for alternative assets. At the same time, technology restrictions and trade barriers have eroded revenue and profit growth in developing countries from South Korea to Brazil.

“We stay cautious on emerging-market equities in a global context, as tariff-related risks continue to weigh more heavily on sentiment in EM,” said Nenad Dinic, an equity strategist at Bank Julius Baer. “Earnings-per-share estimates for 2025 flipped back to a downward trend after the 90-day tariff pause, reflecting concerns about tariff pressures building into the second half of the year.”

ADVERTISEMENT

CONTINUE READING BELOW

This year started with most emerging-market money managers bracing for a stronger dollar as they expected Trump’s tariffs to delay US monetary easing and drive more bids for the greenback. That translated into a weak outlook for developing-nation stocks, which typically do poorly when the dollar strengthens.

But those assumptions were flipped on their head when Trump’s policies ended up pushing global investors to diversify, resulting in portfolio outflows from the US that weakened the dollar. Emerging markets were a prime beneficiary, as investors backed themes ranging from Asian artificial-intelligence companies, miners in Africa and turnaround stories in frontier markets.

“The over-riding positive impact on emerging markets of the Trump administration has been via the weaker US dollar,” said Hasnain Malik, a strategist at Tellimer in Dubai. “Ironically, the fear of the erosion of checks and balances in the US has driven capital inflow into EM, which is precisely the asset class associated with this problem.”

But while the sentiment-driven rally gives the impression that emerging markets are resilient to trade disruptions, corporate fundamentals tell a different story. Almost half of all the companies in the MSCI EM index have failed to meet analysts’ expectation for profits this year, with the average miss being nearly 8% below estimates. Export-oriented sectors such as commodities and industrials have been among the worst hit.

And Trump’s policies are increasingly being cited in earnings reports as the reason for poor performance. Samsung Electronics Co.’s chip unit shocked investors by reporting quarterly operating profit that was 85% below estimates. The main drag was a higher inventory cost for unsold AI chips caused by US export controls.

Indian stocks then became investors’ biggest underweight call after Trump imposed a 50% tariff on the country’s exports, according to Nomura Holdings Inc. A Bank of America Corp. survey found that the world’s fifth-biggest economy had gone from fund managers’ top Asian pick to their least preferred in just three months.

Tata Motors Ltd., the Mumbai-based parent of Jaguar Land Rover, reported a 63% drop in net income earlier in August. The company blamed US tariffs that it calculated had cost it an extra $341 million.

ADVERTISEMENT:

CONTINUE READING BELOW

That has made analysts start to trim back their forecasts for profits in the next 12 months. Average projections for the MSCI index have come down by about 1% in the past eight weeks. Even so, earnings have to jump 11.4% in the next 12 months to meet current estimates.

Trump’s tariffs aren’t the only threat bringing down corporate earnings. An intense price war is also dragging on Chinese consumer companies, and cheaper oil is hurting Middle Eastern producers.

Still, investors have probably not yet seen the full effects of Trump’s levies because companies accelerated their exports to the US ahead of tariff deadlines, according to Julius Baer’s Dinic. Those “front-loading buffers” will fade in the coming months.

“For emerging-market earnings, that means the risk profile skews more to the downside as we get further into the year,” he said.

© 2025 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

3 days ago

1

3 days ago

1

English (US) ·

English (US) ·