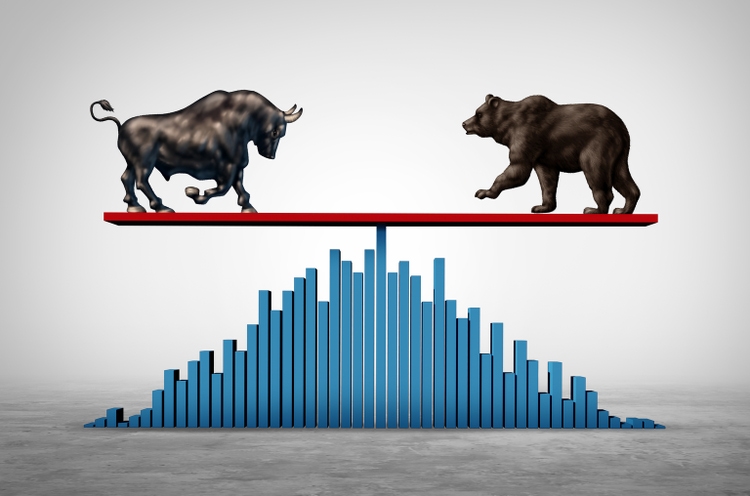

President Donald Trump’s attempt to fire Federal Reserve Governor Lisa Cook has triggered a legal showdown over the central bank’s independence. But on Wall Street, at least some investors aren’t worried about institutional norms; instead, they’re excited about the prospect of cheaper money over time.

“This is very positive,” Jay Hatfield, CEO of Infrastructure Capital Advisors, told Fortune. “The simple way to say it is that eliminating Fed incompetence is far more important than defending alleged Fed independence. The Fed has always been political; it’s only Trump who talks about it in public.”

Indeed, markets largely shrugged off the announcement, to the bewilderment of some economists: Robin Wigglesworth of FT Alphaville argued markets are being “preposterously sanguine.”

“Entrenched expectations of institutional integrity are now kaput,” Wigglesworth wrote.

The S&P 500 and Dow traded around the flatline Tuesday morning, while the Nasdaq even gained 0.3%. Long-term Treasury yields rose after the Trump move, while short-term yields slipped, steepening the curve, indicating that investors bet rates may fall in the near term but drift higher if a politicized Fed proves less attentive to inflation. The U.S. dollar index was last down 0.3%.

For Hatfield, that’s the point. He argued the Fed is already too tight, with policy rates sitting “150 basis points above neutral,” meaning monetary policy is restraining growth more than it should.

“If Fed funds were at 3% and the president was pushing for big cuts, that would be dangerous,” he said. “But we’re nowhere near that.”

Trump already nominated Stephan Miran to the Fed board after one governor randomly decided to step down earlier this month, so replacing Cook would give him a third voice alongside earlier appointees Michelle Bowman and Christopher Waller. That would tilt the seven-member Board of Governors toward a Republican-leaning majority.

The prospect of a Republican-leaning Fed board is one reason Hatfield thinks cuts are coming.

“A tariff is like a one-time tax—it shows up in CPI once and then disappears,” he said.

Waller and Bowman, who both dissented in last month’s decision to hold rates steady, understand that tariffs aren’t a persistent inflation driver, Hatfield added. On the other hand, Democratic-appointed governors misunderstand that, causing them to “delay cuts and put the economy at risk.”

“So getting rid of the Powell Fed is very positive for the stock market and the bond market,” he said.

In the short term, Hatfield expects at least two cuts this year, echoing Fed chair Jerome Powell’s recent dovish signals.

“Overnight you saw a knee-jerk selloff in bonds, but if we’re going to get cuts, that’s great for bonds and great for stocks,” he said.

Independence at risk, with only fragile guardrails from the market

Other economists are far less optimistic. David Wessel of Brookings warned Trump “seems determined to control the Fed—and will use any lever he has to get a majority,” calling it another step in undermining democratic foundations.

Analysts at Piper Sandler were more direct, arguing investors are deluding themselves if they think markets will discipline Trump.

“What is the basis for believing the so-called bond vigilantes will scold Congress before a crisis is at hand?” they wrote, pointing out markets didn’t foresee the inflation shock of 2022 or the housing bust before the global financial crisis. Instead, they argued, stocks are simply rallying at the prospect of rate cuts, “even if they may come in part due to political pressure.”

The bigger risk the analysts are pointing to is structural. As analyst Jim Bianco explained on X, the Fed’s seven governors must reapprove—or veto—all 12 regional Federal Reserve Bank presidents when their five-year terms expire in February 2026.

With more Trump appointees on the board, even leaders like Austan Goolsbee in Chicago or John Williams in New York could find their jobs at risk, reshaping the balance of the FOMC.

Piper warned the “pillars of the long bull market are being removed one by one,” with freer trade reversed and “the sound money pillar in the process of being fundamentally compromised.” The market, they concluded, is unlikely to serve as a check on the politicization of the Fed.

For now, the markets are focused on near-term easing.

UBS Global Wealth Management strategist Ulrike Hoffmann-Burchardi told clients that her team still expects the Fed to deliver 100 basis points of cuts over the next four meetings.

“We will continue to monitor rising political pressure on the Fed,” she wrote in a note, “but expect its decision-making to remain guided by its mandate in the near term.”

Hatfield, for his part, is unconcerned about what he calls “alleged independence.”

“Inflation is already contained, the labor market is weakening, and we’re headed into recession,” he said. “The real story isn’t Trump versus the Fed—it’s that the Fed has been incompetent for decades, and markets know it. Any step toward fixing that is positive.”

This story was originally featured on Fortune.com

2 hours ago

1

2 hours ago

1

English (US) ·

English (US) ·