- Goldman Sachs is reportedly cracking down on talent poaching by asking junior bankers to certify every three months that they haven’t taken job offers from private-equity firms. The loyalty oaths are the latest in an industry-wide effort to retain young bankers at the beginning of their analyst roles. But such initiatives could have an opposite effect, experts tell Fortune.

Goldman Sachs plans to confirm with junior bankers every three months that they haven’t lined up private-equity jobs in an effort to crack down on talent poaching. But that comes with its own risks.

The initiative, first reported by Bloomberg, is the latest move by large investment banks to push back against PE firms that recruit junior analysts during their on-the-job training, or even before they start setting foot on their job sites.

The practice, called on-cycle recruiting, has frustrated banks unable to retain talented workers after their initial contracts end. But experts tell Fortune that loyalty oaths and other measures to prevent poaching can have an opposite effect.

“I have seen the same thing with non-compete agreements,” Paul Webster, managing partner at Page Executive North America, a search and recruitment firm, told Fortune. “It’s almost like the stricter the rules that the employer wishes to place on the company, the more it creates a backlash in the candidates of their level of loyalty and their willingness to leave.”

Webster, who’s worked in financial recruitment for 25 years, said that for the last decade, young workers in finance have seen working at PE firms as an option for a better work-life balance, something they now tend to value more than working 80-plus hours each week to earn the most money possible.

But investment banks want a return on investment from their new workers, who reach prime productivity levels after their first two years at a bank, he said. Once they’re trained, the worker can do more, like contributing to big M&A deals.

“When I speak to the senior investment bankers, they’ll say, ‘Look, when we hire a new graduate, the first two years are really training, and we’re not really getting value out of them,’” Webster explained. “So that’s effectively money out from our firm in terms of the salaries and the training they’ve been given.”

It goes back to the carrot versus the stick.

Webster said efforts to retain employees that don’t come with monetary incentives could instead cause them to leave after their two-year contract is up.

“It’s counterproductive to what the bank’s trying to achieve, because all it’s then doing is it’s creating loyalty in them to stay there while they’re doing training, but it’s creating disloyalty from them when they’re actually going to be the most productive,” he added.

In fact, Morgan Stanley abandoned a policy in 2013 that prevented first-year bankers from speaking with recruiters for outside firms after employees complained, Bloomberg reported.

But PE firms’ tradition of recruiting junior bankers near the start of their on-the-job training is targeting them earlier and earlier, as an arms race spurs companies to scoop up young talent before other firms beat them to it.

For example, someone who graduated in the spring gets hired to start a job at a major bank in the fall. But even before that first day—as early as June—PE firms might interview recent grads, Michael Ewens, a finance professor at Columbia Business School, told Fortune. The result is that those recruits can secure a job change two years in advance, once their contracts at the banks expire.

“That, to my understanding, peaked about a year ago,” he said.

Changes in the Talent Recruitment Process

JPMorgan CEO Jamie Dimon criticized on-cycle recruiting last year during a talk at Georgetown University, saying it’s “unethical,” and puts junior bankers in a “terrible position.”

“It puts us in a bad position, and it puts us in a conflicted position,” Dimon added. “You are already working for somewhere else and you’re dealing with highly confidential information.”

Last month, JPMorgan told incoming graduates they’d be fired if they accept future jobs elsewhere before they complete their first 18 months.

Private-equity firms got the message. In June, Apollo Global Management told prospective investment banking candidates in a letter that it wouldn’t interview or extend offers this year to the class of 2027. CEO Marc Rowan said he agreed with recent criticisms that the hiring process for young recruits had started too early.

“When great candidates make rushed decisions it creates avoidable turnover—and that serves no one,” he told Bloomberg.

Robin Judson, president of financial recruiting firm Robin Judson Partners, told Fortune she expects a larger crackdown on on-cycle recruiting to create more “real time recruiting,” or PE firms reaching out to prospective workers near the end of their initial contracts. She also expects the change to shift perspectives for young people going into finance.

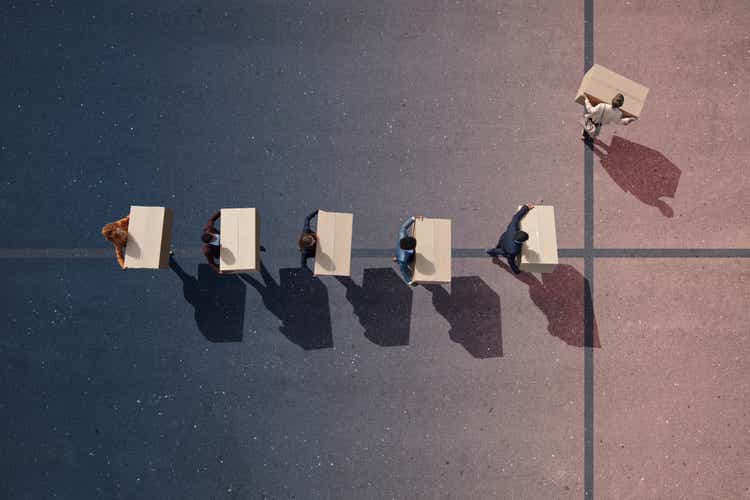

“These junior people just automatically thought they should be going to private equity, and so they prepped for the on-cycle process,” Judson said. “It was a little bit of just following the crowd and not really thinking about what made them happy, or what they were most interested in.”

This story was originally featured on Fortune.com

5 hours ago

1

5 hours ago

1

English (US) ·

English (US) ·