- Markets barely reacted as President Trump extended the U.S.-China trade truce for another 90 days, keeping tariffs at 30% for the U.S. and 10% for China. Despite hints that Beijing and Washington are closing in on a deal, trading patterns for early 2025 show that U.S. importers are steering clearer of working directly with China.

This time last year if the U.S. had been on the brink of an 145% tariff increase on exports from China, markets would have been in meltdown. They would have spiralled even further if they believed a reciprocal 125% hike would be put in place by Beijing.

Fast forward to 2025, and the end of President Trump’s 90-day pause in a tit-for-tat trade war with China approaches with little drama.

Markets have become accustomed to the White House’s malleable deadlines, to say the least. In fact, investors got so comfortable with the U-turns that the phrase “TACO” (Trump Always Chickens Out) was coined to describe how they bet on the markets.

And the Oval Office didn’t disappoint. The White House announced yesterday that a further three-month delay had been agreed with China. As such, reciprocal tariffs rates will remain at the rolled-back position of 30% for the U.S. and 10% for China.

Once upon a time, this decision would have been an eleventh hour save—but in 2025 markets barely blipped. Before the opening bell in New York, S&P 500 futures are flat, after the index closed down 0.25% yesterday. The Dow Jones closed down 0.45% and the Nasdaq was down 0.3%.

Over in Asia, instead of being rocked by tension with their Western neighbors markets were positively upbeat. Tokyo’s Nikkei 225 bounced up 2.15% on opening, Shanghai’s Composite Index was up 0.5% and Hong Kong’s Hang Seng Index was up 0.25.

Europe was relatively flat on opening: London’s FTSE 100 was up a modest 0.27% while Germany’s DAX was down a minor 0.1%.

“Trump retreated from today’s deadline for higher trade taxes in imports from China. Markets expected this,” noted UBS’s Paul Donovan to clients this morning.

Likewise Deutsche Bank’s Jim Reid wrote to clients Tuesday morning that investors are eyeing the end of the week as the market-mover, casting the near-miss on China into the background.

“Markets have been relatively subdued over the last 24 hours, as investors await today’s U.S. CPI print and the much anticipated Trump-Putin summit on Friday,” Reid said. “One obstacle for the week has passed as Trump last night extended the U.S.-China trade truce for another 90 days. The previous deadline was due to expire today. So with investors very much in wait-and-see mode, major asset classes only saw modest moves yesterday, with the S&P 500 (-0.25%) closing slightly lower, whilst 10yr Treasury yields (+0.3bps) moved very little all day.”

Some have defended Trump’s see-sawing positions, saying the Oval Office has been right to give its negotiators more room to breathe. Last month, JPMorgan’s CEO, Jamie Dimon, told an event in Ireland that Trump had been right to extend certain deadlines, saying: “I hate to use the word ‘TACO trade’ because I think he did the right thing to chicken out.”

He added, per the Financial Times: “Unfortunately, I think there is complacency in the market” which is now depending on such swings and delays in policy.

Shifting patterns

The crux of the negotiations during the first delay between Washington and China was coming to an agreement on rare earth minerals. On this, U.S. Trade Representative Jamieson Greer said talks are “about halfway there.”

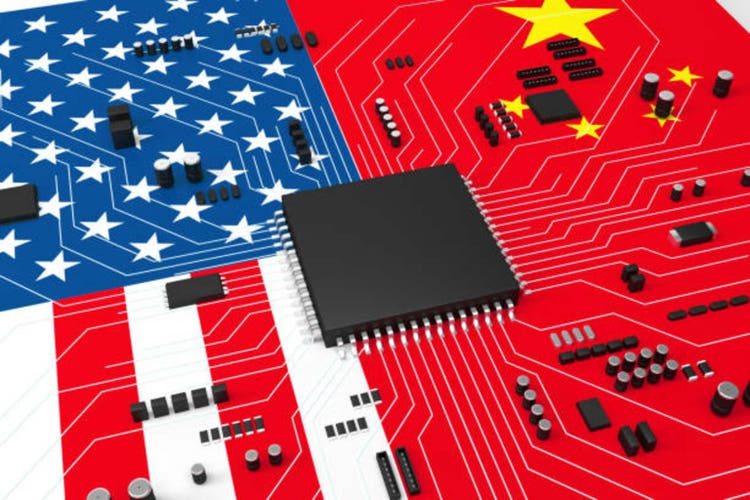

But despite signs that the nations are closing in on a deal, trade patterns have already shifted toward a new reality where the countries work less closely together. Whether this will result in President Trump’s much-preferred domestic growth, or merely exporting from cheaper nations, remains to be seen.

Oxford Economics’s lead economist Adam Slater noted to clients yesterday that the two biggest slumps in imports to the U.S. came from Canada (where imports are down 25% from January) and China, where imports are down 50% from January.

Slater added: “China’s share in U.S. imports has halved since the start of the year to just 7%. Given the large size of the tariff hikes imposed on China, this is not too surprising. But we would note that there is some uncertainty about the real scale of the impact of tariffs on China—Chinese data on exports to the U.S. shows a much less dramatic decline of around 25% since January. This may partly reflect re-routing of Chinese goods through other countries.”

The economist noted that tariffs are “highly uneven” between headline rates and applied rates on certain nations, due to various sectoral tariffs and exemptions. This week alone, for example, Trump allowed chipmakers Nvidia and AMD to sell in China as long as they shared 15% of the revenues with the U.S. government.

How this fits in with tariff negotiations remains to be seen, but Slater adds: “What is clear is that the wide variety of tariff rates across U.S. trading partners implies a lot of scope for trade patterns to shift, with U.S. importers shifting away from highly tariffed countries like China. Some of this may already be visible in the data.”

Here’s a snapshot of the action prior to the opening bell in New York:

- S&P 500 closed down 0.25% yesterday. S&P futures were flat this morning, premarket.

- STOXX Europe 600 was flat in early trading.

- The U.K.’s FTSE 100 was up 0.15% in early trading.

- Japan’s Nikkei 225 was up 2.15%.

- China’s CSI 300 was up 0.5%.

- India’s Nifty 50 was down 0.4%.

- Bitcoin fell to $118,529K.

This story was originally featured on Fortune.com

3 hours ago

1

3 hours ago

1

English (US) ·

English (US) ·