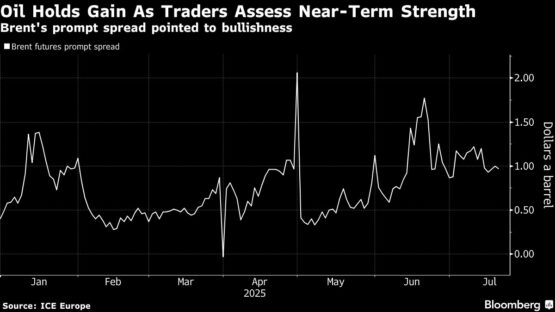

Oil held a gain after US data showed the world’s largest economy holding up despite the fallout from the Washington-led trade war, while crude market metrics pointed to near-term tightness.

Brent traded above $69 a barrel after advancing by more than 1% in the previous session, while West Texas Intermediate was near $67. In wider markets, strong US data eased concerns about the economy, helping to underpin a risk-on mood and global equity rally. Asian stocks advanced.

ADVERTISEMENT

CONTINUE READING BELOW

Crude futures, as well as those for gasoil, remain in backwardation in the nearer months of their curves, which means traders are having to pay more to secure prompt supplies. That pattern points to tight conditions even as producers’ cartel OPEC+ has been relaxing output curbs at a rapid clip.

Oil is higher so far this month, following gains in May and June. Both Morgan Stanley and Goldman Sachs Group have made the case in recent days that while global crude stockpiles have been expanding, the substantial builds have occurred in regions that don’t hold much sway in price-setting. The diesel market has also been tight, especially in Europe and the US.

“The logic of diesel tightness propping up crude flat prices remains unchanged,” said Huang Wanzhe, an analyst at Dadi Futures Co., who added that the peak-demand season had seen a solid start. “The key question is how long this strength can last,” she said.

In Europe, gasoil stockpiles in the Amsterdam-Rotterdam-Antwerp hub have sunk to the lowest seasonal level since 2022, while the crack — a gauge for the profitability of making diesel — has risen to the highest since March 2024.

|

© 2025 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

4 hours ago

1

4 hours ago

1

English (US) ·

English (US) ·