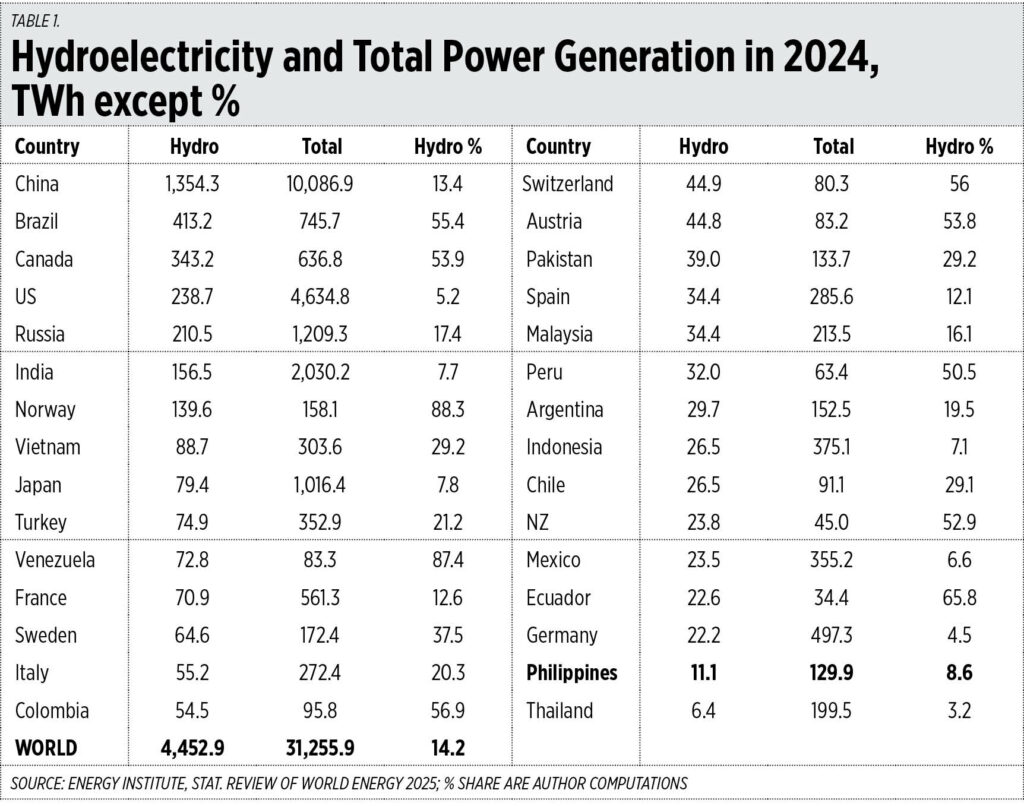

The Philippines experiences plenty of flooding yearly. Our problem is we have too much water and thus floods, but we do not have enough dams, weirs, artificial lakes, and other water catchment and storage structures to take advantage and control all that water. In 2024, hydroelectricity contributed 11.1 terawatt-hours (TWh) or 8.6% of our total power generation.

Many Asian nations hydroelectricity generation is high, like China with 1,354 TWh, Vietnam with 89 TWh, Malaysia has 34 TWh, and Indonesia’s 26 TWh (see Table 1).

On June 10, the Energy department released the Notice of Award for Green Energy Auction 3 (GEA-3) for Pumped-Storage Hydropower (PSH) with a combined capacity of 6,100 megawatts (MW) in Luzon alone. The Energy Regulatory Board’s (ERC) recommended rates are high, up to the P5.36/kilowatt hours (kWh) of Olympia Violago Water and Power, Inc.’s Wawa PSH, and the P5.46/kWh of Ahunan Power, Inc.’s Pakil PSH.

Since these are for ancillary services (AS) only and not for baseload running 24/7, the rates are expensive.

Then last Friday, July 4, the Power Sector Assets and Liabilities Management Corp. (PSALM) accepted bids for the privatization of the Caliraya-Botocan-Kalayaan (CBK) hydroelectric power plants, which produce 797 MW. The Aboitiz Power (AP)-led Thunder Consortium won with an offer of P36.27 billion, higher than PSALM’s reservation value of P32.6 billion, and much higher than the offer of the second bidder, the FirstGen-led FWKG Consortium, of P19.62 billion.

The AP-led consortium still must undergo the post-bidding and qualification process before CBK can be awarded to them by PSALM. Because of this deal with AP and its partners in the consortium, next year the Department of Finance (DoF) will have P36 billion in new revenue without raising any taxes. Such proceeds will be used to retire some stranded debt of the National Power Corp.

But there are questions, including why Finance Secretary Ralph G. Recto’s earlier estimate of up to P50 billion was not reached. There were even insinuations made by the leftist and anti-capitalist group Bayan Muna that it was a “sweetheart deal” between AP and PSALM.

I think the main reason CBK did not get anything close to P50 billion is because GEA-3 technically downgraded it. The CBK plant is also used for PSH, and PSH is a crowded business with 6,100 MW already awarded at much higher rates than CBK’s roughly P2.80/kWh.

Among the uncertainties surrounding CBK are: first, while there is no pre-set tariff rate by ERC yet, GEA-3-awarded PSH have high guaranteed rates already; second, electricity prices at the Wholesale Electricity Spot Market are currently low, between P3-P4/kWh; third, the PSH field under GEA-3 is, as mentioned above, crowded; and, fourth, much will have to be spent to upgrade the old plants.

Mr. Recto’s estimates were made pre-GEA-3 while the PSALM reservation value of P32 billion was made post-GEA-3 and, hence, reflected new risks of the overcrowded PSH.

In short, PSALM and the DoF are still lucky to get P36 billion from AP and its partners. The anti-capitalist Bayan Muna is wrong to make any malicious insinuations.

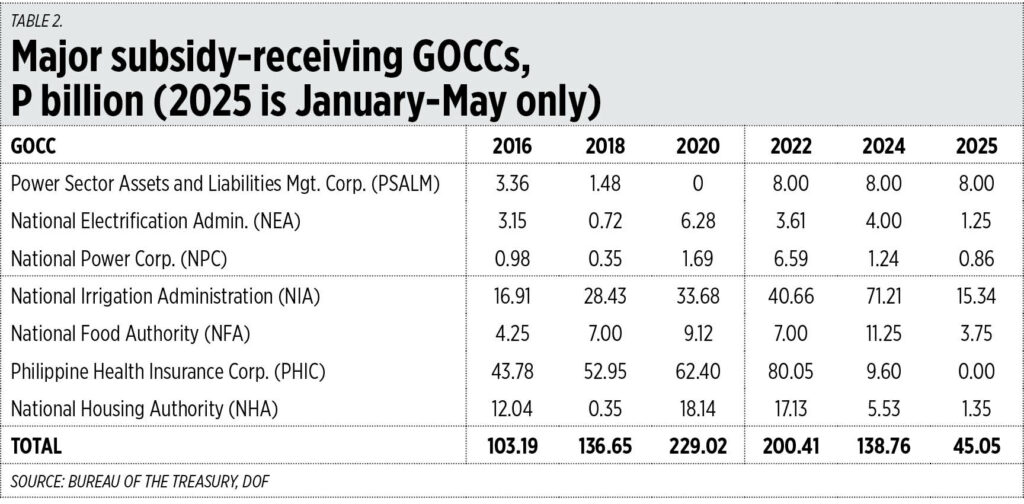

PSALM is getting P8 billion a year from 2021-2025, or P40 billion over five years. I think this is meant to cover the debt of some electric cooperatives (ECs) in Mindanao that do not pay for the power they get from hydro plants operated by PSALM.

Many ECs are inefficient and wasteful; they stay afloat mainly because of the taxpayers’ subsidy to the National Electrification Administration (NEA) and it then sends the money to these inefficient ECs. Subsidies to the NEA came up to P5.65 billion in 2014, P6.28 billion in 2020, P4 billion last year, and P1.25 billion until May this year (see Table 2).

PSALM should privatize more hydro plants, especially in Mindanao, but many politicians and legislators there oppose this move. One way to convince them to agree would be to allocate to the island the interest payments avoided from NPC debt that otherwise would be borrowed. For instance, if the hydro plants in Mindanao would get, say, P200 billion, at an interest rate of 6.3% (government 10-year bonds), that comes up to P12.6 billion a year of avoided interest payments. This amount should be allocated as an additional budget for Mindanao.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.

10 hours ago

1

10 hours ago

1

English (US) ·

English (US) ·