By Lourdes O. Pilar, Researcher

YIELDS on Philippine government securities fell last week as investors took profits after the Bangko Sentral ng Pilipinas’ (BSP) surprise rate cut and amid expectations of further monetary easing.

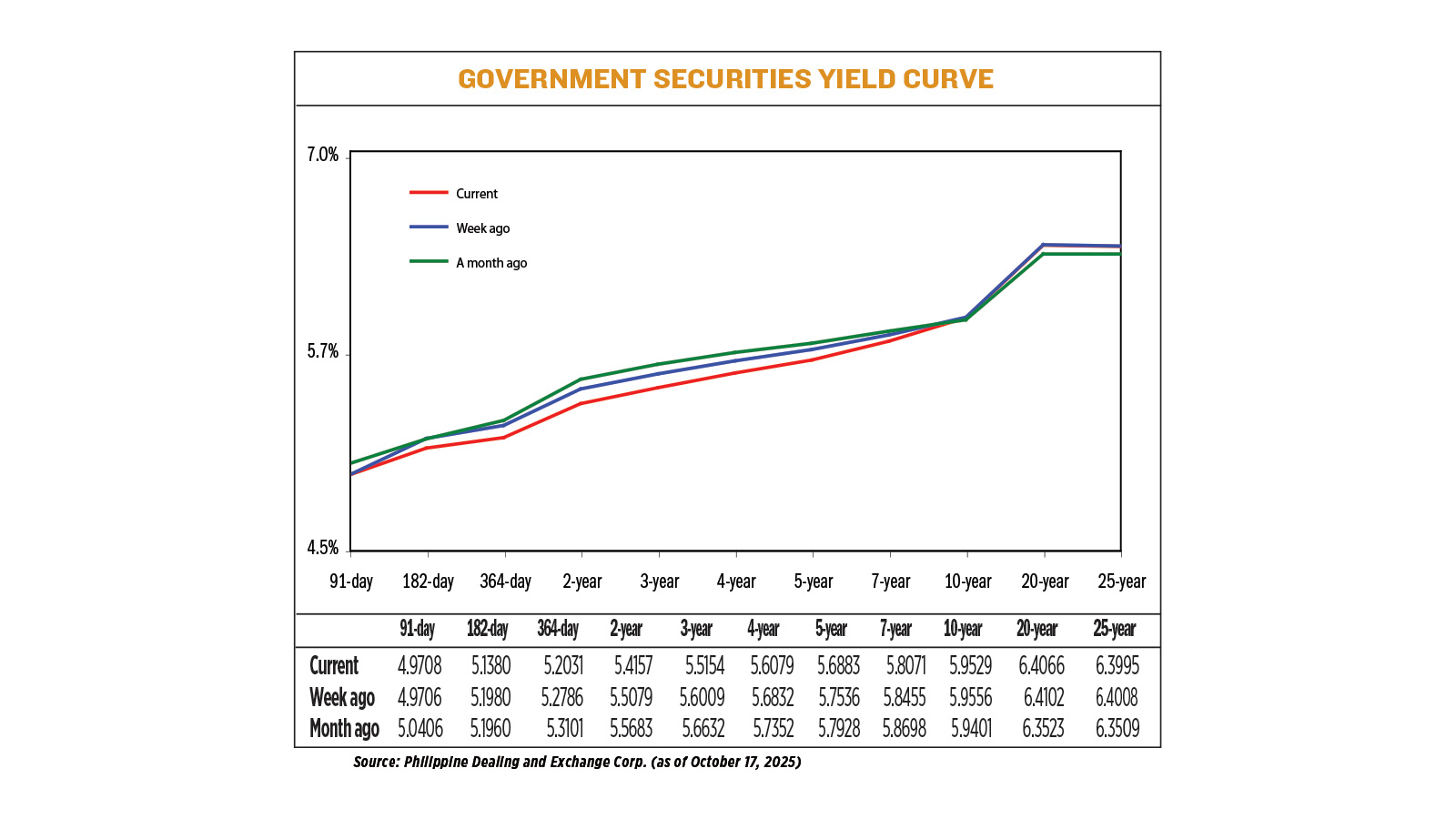

Government debt yields declined by an average of 4.54 basis points (bps) week on week based on PHP Bloomberg Valuation Service (BVAL) reference rates as of Oct. 17. Trading volume dropped to P50.28 billion on Friday from P148.2 billion a week earlier.

Yields fell across most tenors except the 91-day Treasury bill, which inched up by 0.02 bp to 4.97%. The 182- and 364-day T-bills slipped by 6 and 7.55 bps to 5.14% and 5.2%, respectively.

The two- to seven-year Treasury bonds also declined, led by the two-year debt at 5.42%. Ten-year to 25-year yields were little changed, edging lower to 6.4% at the long end.

“The local bond curve shifted lower, led by the front and belly, on firm demand and continued expectations of further BSP easing,” a bond trader said in a Viber message. Profit taking capped the rally as investors locked in gains.

The BSP unexpectedly cut its policy rate by 25 bps to 4.75% on Oct. 9 — the lowest in more than three years — citing weaker sentiment amid a corruption scandal involving flood control projects. Rates on the overnight deposit and lending facilities were also reduced to 4.25% and 5.25%, respectively.

Traders said the BSP might cut by another 25 bps in December and an additional 50 bps next year. “The BSP remains dovish and ready to provide support to the economy,” another trader said.

Demand for Treasury bills remained strong. The Bureau of the Treasury raised P22 billion as planned from its latest auction, with bids reaching P97.2 billion — more than four times the offer.

The average rate for 91-day bills dropped 10 bps to 4.88%, while 182-day and 364-day tenors fetched 5.07% and 5.12%, respectively.

Jonathan Ravelas, a senior adviser at Reyes Tacandong & Co., said the outlook for local rates remains “sideways to down,” supported by easing inflation and global rate cut prospects.

Traders expect the yield curve to steepen slightly this week, with short-term rates declining further while medium- to long-term yields edge higher.

4 hours ago

1

4 hours ago

1

English (US) ·

English (US) ·