US companies are planning to buy back shares at a historic pace, a sign of Corporate America’s confidence in the economy, with Nvidia Corp being the latest to add its name to the long list of repurchase plans.

Announced buybacks surpassed $1 trillion on August 20, marking the shortest amount of time needed to reach that level, according to data compiled by Birinyi Associates. The previous record was in October last year.

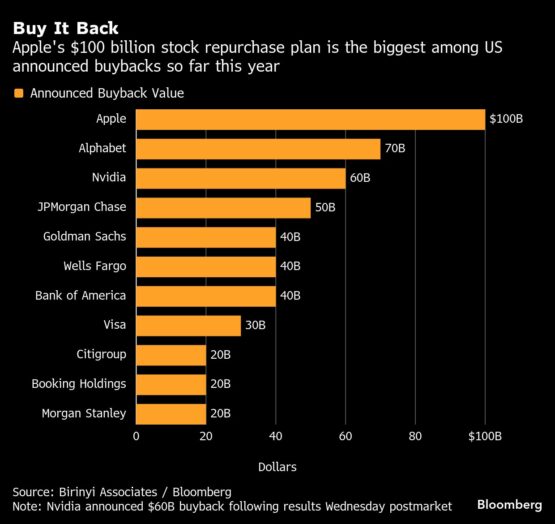

Over the last few months, corporate heavyweights — particularly in financials and technology — have given the green light to large share-repurchasing programmes. On Wednesday, Nvidia announced plans to buy back $60 billion worth of stock following its quarterly results after the market closed.

Back in May, Apple announced it would buy back $100 billion in stock. Alphabet, JPMorgan Chase & Co, Goldman Sachs Group, Wells Fargo & Co and Bank of America Corp have also announced buybacks of at least $40 billion.

ADVERTISEMENT

CONTINUE READING BELOW

“There is going to be a continuation of the ultimate dip buyer in the market, which is the company themselves,” said Jeffrey Yale Rubin, president of Birinyi Associates. “Earnings are good, they have enough money for capital expenditures, and this is a nice way to reward investors and owners of the company.”

Last month, announced share repurchases totalled $166 billion, the highest dollar value on record for July as buyback plans from the largest American financial and technology companies kicked in. Buybacks offer a crucial pillar of support for the US stock market, which has seen the S&P 500 Index return to all-time highs in recent weeks. A pipeline of stock repurchase programs indicates rising confidence among corporate executives.

ADVERTISEMENT:

CONTINUE READING BELOW

Rubin expects the momentum to continue through to the end of the year, forecasting announced buybacks to reach $1.3 trillion and completed repurchases to reach a record.

“Absent a dramatic slowdown in the economy, we forecast that 2026 completed buybacks will reach $1.2 trillion, which would be a new record,” Rubin wrote in a note published on August 26.

Buybacks have drawn the ire of some members of the Trump administration, having been a topic in the wrangling over President Donald Trump’s signature tax bill. Speaking on Fox Business on Wednesday, Treasury Secretary Scott Bessent took aim at Boeing Co for a “massive” share buyback the company did instead of investing in research and development.

© 2025 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

3 days ago

2

3 days ago

2

English (US) ·

English (US) ·