YIELDS on government securities (GS) ended mixed last week after the Bangko Sentral ng Pilipinas (BSP) signaled two more rate cuts this year amid slowing inflation.

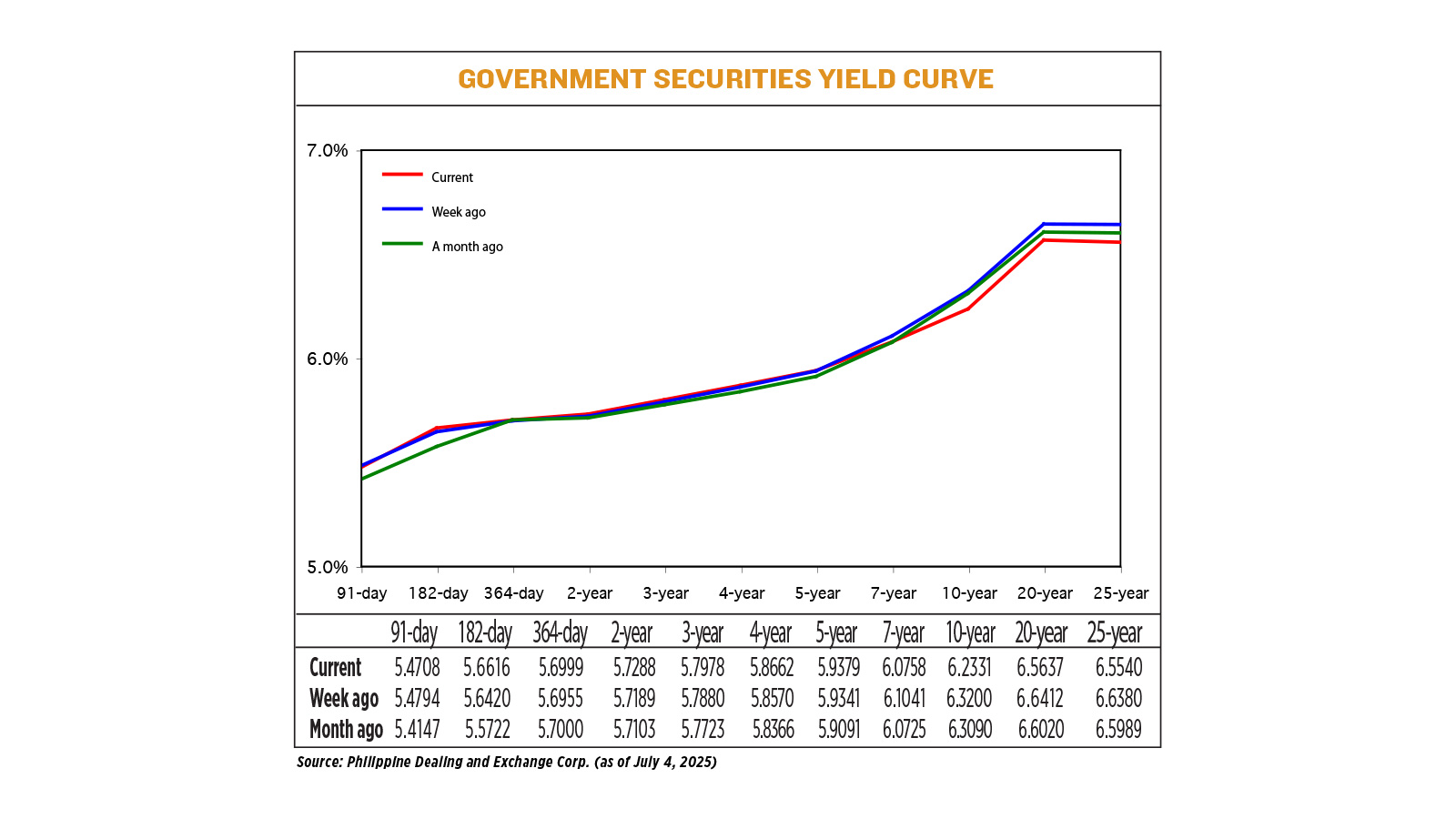

The yields, which move opposite prices, fell by an average of 2.08 basis points (bps) week on week, based on PHP Bloomberg Valuation service reference rates as of July 4 posted on the Philippine Dealing System website.

Short-term government securities saw mixed movements on Friday, with the three-month Treasury bill slightly easing, while the six- and 12-month tenors posted small increases in yields.

In the mid-range or “belly” of the curve, most bond yields edged higher, except for the seven-year tenor, which declined modestly.

Long-term bond yields, on the other hand, generally fell across the board, led by a notable drop in the 10-year paper.

Total government securities traded rose to over P56 billion, up from around P40 billion in the previous session.

“The yield curve shifted flatter by 3-7 bps [last week] after dovish comments by BSP Governor Eli Remolona that two further rate cuts would be ideal for the economy,” Dino Angelo C. Aquino, vice-president and head of fixed income at Security Bank Corp., said in an e-mail on Friday.

He added that the lower-than-expected June inflation of 1.4% “would likely boost the BSP’s dovish stance, which would be beneficial for local bonds moving forward.”

“Yields are slightly lower partly due to inflation but since the US trade deadline looms, we are still not seeing strong downward momentum for yields,” a bond trader said in a Viber message.

On Thursday, the BSP chief signaled at least two more rate cuts due to benign inflation.

Last month, the central bank cut its benchmark rate by another 25 bps to 5.25% — the second straight reduction this year.

Inflation in June ticked up slightly to 1.4% from 1.3% in May due to higher electricity and education costs, though this was tempered by slowing food prices. It was the fourth straight month that inflation remained below the BSP’s 2-4% target.

Year-to-date inflation averaged 1.8%, still above the revised full-year forecast of 1.6%.

The Monetary Board is scheduled to hold its next policy meetings on Aug. 28, Oct. 9 and Dec. 11.

“Nonetheless, with the solid local macro backdrop, expect local bonds to be well supported and be less sensitive to US bond movements in the short term,” Mr. Aquino said.

“At the end of the day, [the market] will have to consider interest rate differentials versus the US unless there’s a gloomy economic activity locally,” the bond trader said. — LPQB

9 hours ago

1

9 hours ago

1

English (US) ·

English (US) ·