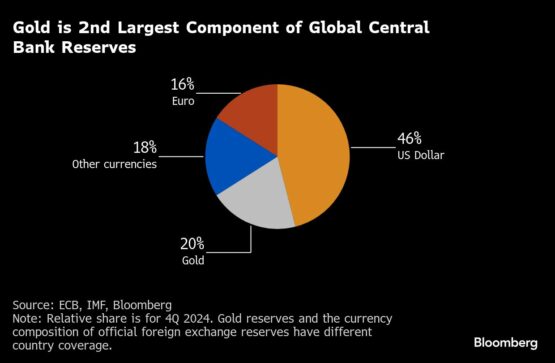

Record-high purchases and a blistering rally in prices has seen gold overtake the euro as the second-largest asset in the reserves of the world’s central banks.

The share of gold in global foreign reserves at market prices reached 20% at the end of 2024, surpassing the euro at 16%, the European Central Bank said in an annual assessment of the currency’s international standing. The US dollar extended a steady decline to reach 46% of global reserves.

ADVERTISEMENT

CONTINUE READING BELOW

Gold’s dizzying rise — prices have doubled since late 2022 — has been fueled in part by central bank purchases. Sovereign institutions have bought more than 1 000 tons a-year for the past three year, twice as fast as their average pace of purchases prior to 2022. Their holdings are now back at levels last seen in the late 1970s.

“Gold demand for monetary reserves surged sharply in the wake of Russia’s full-scale invasion of Ukraine in 2022 and has remained high,” the ECB wrote in the report.

The freezing of Russia’s foreign exchange reserves held in Group of Seven currencies after its invasion of Ukraine spurred some banks to reduce exposure to the Western financial system, as did the threat of inflation and speculation that the US would treat foreign creditors less favorably.

ADVERTISEMENT:

CONTINUE READING BELOW

Gold prices and real yields have historically had a negative correlation, as higher returns tempt investors away from bullion, which doesn’t bear interest. This relationship broke down in 2022, as central banks began to buy the yellow metal as insulation from sanctions risk, in spite of interest rates rising globally, the ECB report added.

“Countries that are geopolitically close to China and Russia have seen more marked increases in the share of gold in their official foreign reserves since the last quarter of 2021,” the ECB economists wrote.

© 2025 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

1 day ago

3

1 day ago

3

English (US) ·

English (US) ·