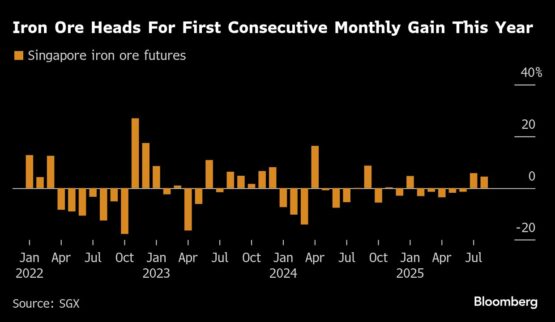

Iron ore headed for a second monthly gain as output cuts at a steel hub near Beijing and a report that authorities will move to limit production next year buoyed prices.

Futures in Singapore were steady near $104 a ton, and are up almost 5% in August. Yuan-priced contracts in Dalian were on track for a third straight monthly gain.

ADVERTISEMENT

CONTINUE READING BELOW

Futures spiked almost 2% on Thursday on a Reuters report that China had drawn up plans to strictly control steel capacity and cut production. While reducing steel output might appear negative for steelmaking ingredient iron ore, it’s likely to improve the health of struggling steel mills and boost prices of the construction metal.

A similar logic has seen iron ore rally on output cuts at steel mills in Tangshan, part of efforts to curb pollution and ensure blue skies for a military parade in Beijing in early September.

Iron ore is headed for its first back-to-back monthly gain since 2024 on improving sentiment, although gains are likely to be capped by a still shaky macroeconomic outlook for China. It’s also still unclear how much of an impact Beijing’s plans to control output will have.

“The growth stabilisation document released this year is similar to the one issued in 2023 and lacks clear policy objectives,” said Steven Yu, a researcher at Mysteel, referring to the document that Reuters cited.

ADVERTISEMENT:

CONTINUE READING BELOW

Mysteel data released this week showed overall demand and inventory pressure in five major steel products was moderate, a positive for expectations for the peak production season in September and October. Stockpiles at major Chinese steel mills rose in mid-August from earlier in the month, according to China Iron and Steel Association figures.

Iron ore was flat at $104.20 a ton in Singapore as of 11:44 a.m. local time, and was up 4.5% for the month. Yuan-priced futures in Dalian declined 0.4%, but have risen 1.1% in August. Elsewhere in ferrous markets, hot-rolled coil and rebar future contracts were mixed. Dalian coking coal contracts fell 2%.

© 2025 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

5 days ago

1

5 days ago

1

English (US) ·

English (US) ·