Oil dropped for a second day as traders fretted that OPEC+ may agree to boost supplies, US data pointed to a slowdown, and an industry estimate showed higher crude stockpiles at a key storage hub.

Global benchmark Brent fell toward $67 a barrel, while West Texas Intermediate was below $64. Prices slumped on Wednesday after a report that the OPEC+ alliance would consider a fresh round of production increases at a policy meeting this weekend. Still, Saudi Arabia and its partners have yet to decide on how to proceed, according to several delegates.

In the US, an industry estimate showed that crude inventories at the Cushing, Oklahoma, storage hub — the pricing point for WTI contracts — expanded by 2.1 million barrels last week. If confirmed by official data later on Thursday, that would be biggest increase since March.

ADVERTISEMENT

CONTINUE READING BELOW

Brent oil has shed about 10% this year as OPEC+ unwound deep output curbs at a rapid clip in a bid to reclaim market share from rival drillers. At the same time, producers from outside the alliance have also ramped up supplies, while concerns about crude demand intensified as the Trump administration imposed a wave of trade tariffs. Taken together, that’s spawned widespread predictions for a glut that will swell global stockpiles.

“With Brent oil futures currently sitting above $65 a barrel, it makes sense that OPEC+ are at least considering boosting production further,” Vivek Dhar, an analyst at Commonwealth Bank of Australia wrote in a note. The challenge for the group is that global refining activity is seasonally weaker, he said.

In the US, the world’s biggest economy, activity saw “little or no change” across most of the country in recent weeks, the Federal Reserve said. In addition, job openings fell to a 10-month low, adding to data that show a diminishing appetite for workers amid heightened policy uncertainty.

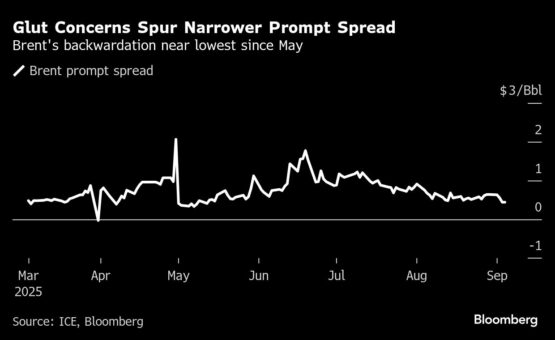

Market metrics point to less-tight conditions. Brent’s prompt spread — the difference between its two nearest contracts — was 45 cents a barrel in backwardation, compared with more than $1 two months ago.

Goldman Sachs Group Inc. reaffirmed a bearish outlook, citing expectations for output to top consumption. “We still see the current oversupply in oil markets intensifying,” analysts including Samantha Dart said in a note on commodities, with a forecast for Brent to drop to the low $50s in late 2026.

ADVERTISEMENT:

CONTINUE READING BELOW

US policy toward Russia, including a drawn-out effort to try to end the war in Ukraine by targeting crude shipments, was also in focus. President Donald Trump hinted that there could be “phase two” or “phase three” measures after he penalised India for purchasing Moscow’s oil.

“Most of Russian exported oil, about 90% of it, is bought by China and India,” US Energy Secretary Chris Wright said in an interview with Bloomberg Television. “So here’s a way where he’s trying to dramatically reduce Russia’s ability to export oil, so they can’t fund the war machine.”

|

© 2025 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

2 days ago

1

2 days ago

1

English (US) ·

English (US) ·