A record share of American firms froze investments in China as trade ties worsened earlier this year, a recent survey suggests.

Fewer than half of the companies surveyed by the US-China Business Council between March and May said they planned to invest in China in 2025, a drop from 80% last year and a record low since the group began asking a similar question in 2006, according to the Wednesday report.

ADVERTISEMENT

CONTINUE READING BELOW

While the annual survey was conducted before the easing of tensions following the countries’ talks in London last month, the sharp fall in sentiment underscores the damaging effect of the trade war on investment in the world’s second-largest economy.

Companies are in a “wait-and-see mode,” Kyle Sullivan, vice president of business advisory services at the USCBC, said in a briefing. “They are riding out the uncertainty in trade policy.”

The survey covers large, US-headquartered multinational companies, with over 40% of respondents representing companies that generated at least $1 billion in revenue in China last year.

US companies have invested heavily in manufacturing in China over the last few decades, taking advantage of relatively cheap labor and the country’s increasingly wealthy consumers. But rising trade barriers and China’s growth slowdown have prompted companies to reassess their presence.

While the country remains an appealing hub for manufacturing and innovation, 75% of respondents cited China’s retaliatory tariffs as their top cost concern, as they often rely on inputs from the US.

ADVERTISEMENT:

CONTINUE READING BELOW

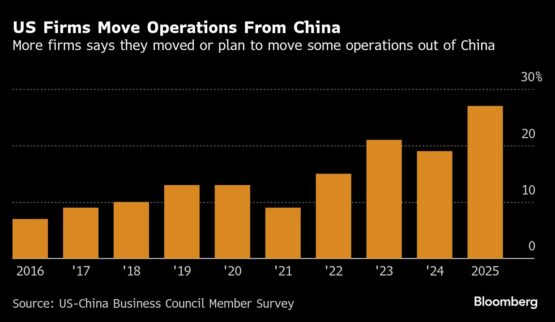

A record 27% of companies said they moved or planned to move some operations out of China, the highest since at least 2016.

Beijing and Washington have seen relations thaw after both sides agreed to approve exports of crucial technologies, with Chinese exports to the US narrowing their drop in June. Still, shipments to the US fell 24% in the second quarter compared to an increase of over 6% for China’s overall exports, according to official data.

The survey also gave a sense of how US companies navigated tariffs. While the most common approach was sourcing from alternative markets, about one third of companies renegotiated prices with suppliers, while a similar share passed higher costs to downstream customers.

Other key findings

- 32% of companies reported losing market share in China over the last three years, and nearly 70% are concerned about losing market share in the next five years

- Around 40% of companies report negative effects from US export control policies, citing lost sales, severed customer relationships, and reputation damage in China

- The proportion of companies reporting impacts from overcapacity rose to 42% over the past year, up from 25% last year

- More than 80% of respondents said China’s industrial policies help Chinese companies that were previously uncompetitive, and nearly 60% of respondents said the policies steer Chinese customers to domestic products

© 2025 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

10 hours ago

1

10 hours ago

1

English (US) ·

English (US) ·