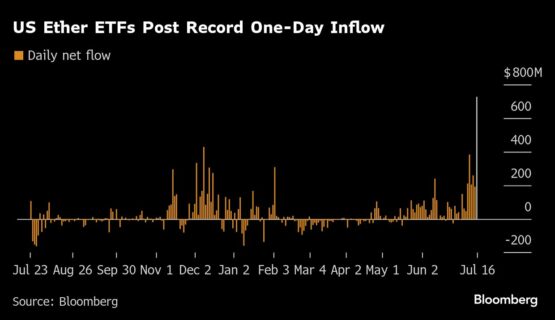

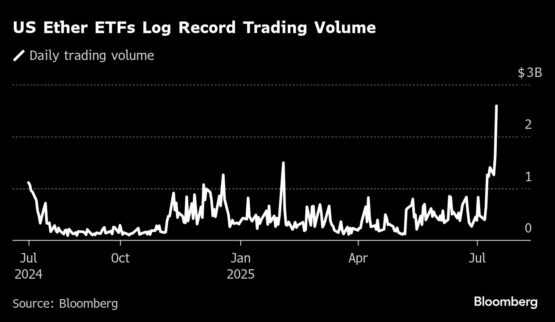

US exchange-traded funds for Ether posted record inflows and trading volumes as key crypto legislation endorsed by President Donald Trump advances.

After a sluggish start to the year, investors on Wednesday poured $727 million into the group of nine ETFs, which also logged $2.6 billion in trading volume as Ether rallied. Open interest in Ether futures on CME Group also hit a fresh high, signaling mounting institutional demand for the second-largest cryptocurrency.

ADVERTISEMENT

CONTINUE READING BELOW

Midway through what’s been dubbed “Crypto Week” by a congressional committee, Republican conservatives on Wednesday dropped a two-day blockade of industry-backed crypto bills, paving the way for House votes on a series of measures backed by Trump.

The rally in Ether adds to the momentum for crypto bulls, who pounced after the November election on bets that the second Trump presidency would usher in a new era of permissive regulation. Broadly speaking, they’ve been rewarded: leading cryptocurrency Bitcoin romped to a record $123 205 on Monday.

Ether, which has long lagged Bitcoin and closer rivals like Solana, rose as much as 2.6% to $3 469 in early London trading on Thursday, its highest level since January.

ADVERTISEMENT:

CONTINUE READING BELOW

Bitcoin slipped 1.4% but continued to hold above $118 000.

© 2025 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

6 hours ago

1

6 hours ago

1

English (US) ·

English (US) ·