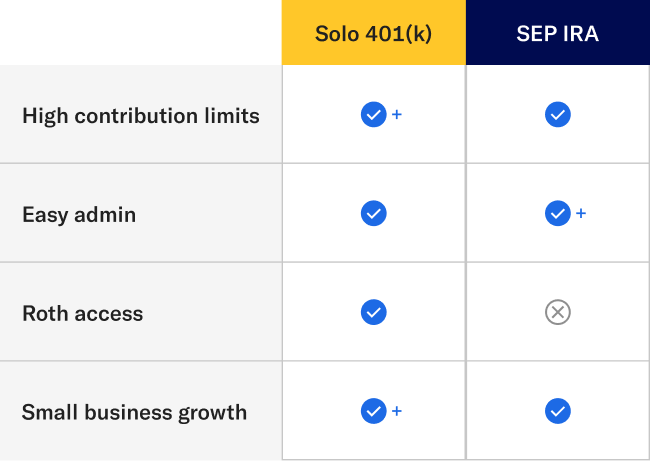

If you’re self-employed, you likely wear several ill-fitting hats: accountant, admin, HR rep. And that last one is low-key important, because it means no one is setting up a retirement plan for you. So what's a gig worker, small business owner, or solo practitioner to do? There’s the trusty IRA, of course. But its tax benefits phase out at certain income levels, and its $7,000 annual contribution limit fills up fast. You may want—or need—to save more to realize your retirement goal. Luckily, two lesser-known retirement accounts offer self-employed workers 10x more capacity for tax-advantaged investing: the solo 401(k) and the SEP IRA. They’re similar in that sense (high contribution limits), but they also differ in some important ways. We’ve found that for many self-employed workers, choosing between the two often hinges on their hiring or lack thereof: 👉 No employees beyond a spouse, and no plans to hire? 👉 See yourself hiring a few employees in the not-so-distant future? 👉 Planning to expand beyond 5-10 employees at some point? That’s the TL;DR version. For a deeper dive, let’s compare the two accounts across a few categories: Both accounts let you save plenty for retirement—upwards of $70,000 a year—but solos give you a couple of ways to stretch that even further: If you're age 50 or older and catching up on your retirement savings, a solo 401(k) offers additional “catch-up” contributions of $7,500 each year, or $11,250 for those 60-63. Note that starting in 2026, any catch-up contributions must go into a Roth solo specifically (more on those below) if you received more than $145,000 in FICA wages (salaries, commissions, etc.) the prior year from your solo’s sponsoring company. Say you earn less than $280,000, but you save well above the standard advice of 10-15% for retirement. In this scenario, you may run up against the SEP’s 25% compensation cap before you reach its overall $70,000 limit. But with solos, you can contribute as both an employer (up to 25% of compensation) and an employee (up to $23,500) until you hit the overall limit. ⚖️ Advantage: solo 401(k) Both a solo 401(k) and SEP IRA, assuming they’re streamlined digital offerings such as ours, are simple to set up. You can open a Betterment SEP entirely online, while a Betterment solo requires a quick call with our Licensed Concierge team to get the ball rolling. Each account type is relatively low maintenance as well. Neither a SEP nor a solo require annual paperwork, with the one exception being for solo 401(k) balances that exceed $250,000. In that case, the IRS requires solo owners (aka “sponsors”) to file Form 5500-EZ. While we’re not a tax advisor, and always recommend working with one, the form is relatively straightforward to fill out. ⚖️ Advantage: SEP IRA

High contribution limits

Case #1: You’re playing catch-up

Case #2: You’re a middle class super saver

Easy admin

Roth access

Solos and SEPs are designed for retirement, so the IRS gives special tax treatment to both account types. But in practice, solos give you not one but two different flavors of tax treatment to choose from:

- You can contribute with pre-tax dollars via a traditional solo 401(k), lowering your taxes now and freeing up more money to invest.

- You also have the ability to contribute with after-tax dollars via a Roth solo 401(k), enjoying tax-free withdrawals in retirement. And Roth solo 401(k)s come with two added bonuses:

- Unlike traditional retirement accounts, they’re not subject to Required Minimum Distributions (RMDs) in retirement.

- Unlike Roth IRAs, they come with no income limits of any kind.

Roth SEP IRAs, meanwhile, have technically been allowed by the IRS since 2023, but few providers have rolled them out yet.

⚖️ Advantage: Solo 401(k)

Small business growth

At some point in your self-employed journey, you may bring on hired help. In this case, it’s possible to transition both account types to accommodate employees. Some SEP providers let you shift from a solo practitioner to an employer who contributes to employees’ SEP IRAs on their behalf. But there’s a catch: you must contribute the same amount to their SEPs as you do your own, which may prove challenging depending on your business.

With solo 401(k)s, on the other hand, you can include a spouse from the get-go, provided they’re an employee or co-owner of the business. And if you see the potential for expanding beyond a handful of employees down the road, it may make sense to simply transition your solo 401(k) to a group 401(k) plan and enjoy more flexibility in how you structure contributions for your team. Our support team handles moves like this often and can help you when the time comes.

⚖️ Advantage: Solo 401(k)

So which account is right for you?

The good news is both SEP IRAs and solo 401(k)s offer excellent tax advantages that can help you reach retirement quicker. We offer both at Betterment, and make it easy to open either one. Because when you’re self-employed, you’re busy running your business. Optimizing your retirement savings? Leave that to us for one less hat in your wardrobe.

8 hours ago

1

8 hours ago

1

English (US) ·

English (US) ·