Sasol’s stock price broke R93 this week, a 45% bump on its May low of around R64. Are institutions falling in love again with a stock that a decade ago traded above R650?

It seems they are, says Kea Nonyana, market analyst at Scope Prime: “Sasol for the past 10 days has been averaging two million daily shares traded.”

ADVERTISEMENT

CONTINUE READING BELOW

Read: KAP escalates legal battle against Sasol over ethylene dispute

Nonyana notes that on Tuesday (15 July) almost 600 000 shares changed hands in the first hour of trade, which shows significant institutional buying.

“This [is] on the back of traders believing that the oil price has found support at $68 a barrel on the fears that US President Donald Trump will impose further sanctions on Russia, which will disturb global oil supply,” she says.

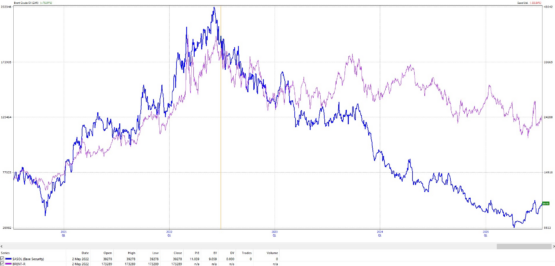

There is a correlation between oil and Sasol’s share price, though that was sundered in 2023 due to falling profits in its mining and gas units, and the chemicals businesses in Africa and the Americas.

The company reported a 52% drop in basic earnings per share for the six months to December 2024, with revenue falling 10% to R122 billion – the culprit here being weaker refining margins and lower oil prices.

Read: Sasol’s interims ‘no surprise’

The drop in earnings was largely the result of write-downs of its Secunda and Sasolburg facilities.

Correlation between oil and Sasol

Sasol skipped dividend payments for the December 2024 six-month period, citing lower oil prices and falling demand.

Oil prices have been ranging lower since the Russian invasion of Ukraine in 2022 when it bounced between $100 and $130 a barrel. This week Brent traded at $68 a barrel.

Listen/read:

Sasol: Five miracles and a dream

Sasol shares jump on news of R4.3bn Transnet settlement

Market’s liking Sasol and Renergen

Nonyana says China has been buying oil at below market prices from Iran, Russia and Venezuela – all of which are sanctioned by the US. This put a cap on the oil price, but any shortfalls have to be purchased at higher prices outside these countries. The recent rally in oil comes as Trump threatened further sanctions against Russia.

In January, Morgan Stanley upgraded its price target for Sasol to R225, which is 150% higher than current price levels.

ADVERTISEMENT:

CONTINUE READING BELOW

The average 12-month forecast for Sasol from nine analysts is R119, with at least one expecting it to top out at R180. That’s double where it is now.

Technically, Sasol has support at R80 with some traders eyeing near-term resistance at R104. Lower oil prices and possible operational setbacks appear to be discounted into the price.

Institutional investors such as Allan Gray and Coronation Resources Fund have taken positions in Sasol at these low levels, citing its attractive valuation relative to future cash flow potential. Sasol is trading at 2.2 times cash flows in recent years.

On a forward price-earnings multiple of 3.16 and a historical dividend yield of nearly 13%, institutional buyers appear to believe the worst is behind it.

That’s not to say the company is completely over the challenges.

The Trump tariffs on Russia are threatened and not actual at this stage. Trump will likely dial these back should oil go much above $70/barrel, which may mean the era of cheaper oil continues a while longer. That will exert downward pressure on the share price.

Then there’s the net debt of R82 billion as of December 2024, most of this denominated in USD, which leaves Sasol vulnerable to currency fluctuations.

On the operational side, Sasol is wrestling with lower-quality coal to feed its plants, dwindling natural gas reserves in Mozambique and over-capacity in the global chemicals market.

In May, Sasol announced that Transnet had agreed to pay it R4.3 billion in full and final settlement of all legal disputes between the two parties. Sasol and TotalEnergies, owners of the Natref refinery in Sasolburg, claimed Transnet had been overcharging for transporting crude oil from the coast.

This settlement provided an immediate boost to the Sasol share price, removing a key uncertainty in its business.

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

8 hours ago

1

8 hours ago

1

English (US) ·

English (US) ·