Gold prices saw a modest recovery on Tuesday, June 17, as escalating geopolitical tensions in the Middle East and investor caution ahead of the U.S. Federal Reserve's policy meeting drove renewed demand for the safe-haven metal.

As of 5:30 PM IST (12:00 PM GMT), the latest available data indicates that spot gold was trading at $3,392.29 per ounce, reflecting a 0.3 per cent increase for the day.

In the U.S., gold futures for the June 2025 contract (GCM25) were last reported at $3,410.90 per ounce, marking a 0.2 per cent decline from the previous session.

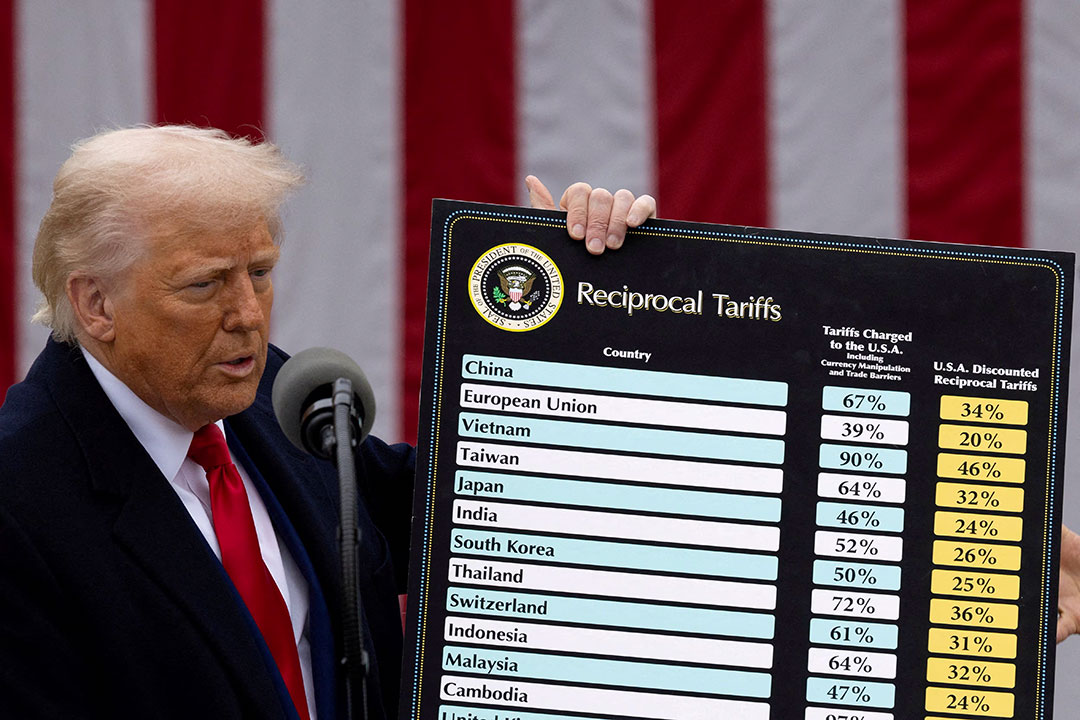

These movements come amid escalating geopolitical tensions in the Middle East, particularly between Israel and Iran, and a call from U.S. President Donald Trump for the evacuation of Tehran. Such developments have spurred increased demand for gold as a safe-haven asset.

In the Indian market, 24-karat gold was priced at Rs. 1,00,370 per 10 grams, while 22-karat gold traded at Rs. 92,000 per 10 grams, according to data from Goodreturns. 18-karat gold was quoted at Rs. 75,280 per 10 grams.

Geopolitical Tensions Drive Safe-Haven Demand

Gold's uptick comes amid renewed conflict in the Middle East. Israel reportedly struck Iran's state broadcaster on Monday, and the UN nuclear agency confirmed damage to a key Iranian uranium facility. These developments have intensified geopolitical risks, boosting safe-haven assets like gold.

The situation escalated further after U.S. President Donald Trump cut short his G7 trip, urging civilians to evacuate Tehran—a move that spooked global markets and raised fears of a broader conflict.

Despite the increased risk sentiment, analysts caution that gold remains volatile, with recent price increases triggering profit-booking among investors.

Fed Policy Meeting in Focus

Market participants are now turning their attention to the U.S. Federal Reserve's two-day policy meeting, which begins Tuesday. While the Fed is widely expected to hold interest rates steady, investors are eager for any guidance on the timing and pace of potential rate cuts in the second half of 2025.

Gold typically benefits from lower interest rates, which reduce the opportunity cost of holding non-yielding assets. However, if the Fed signals a prolonged pause, gold prices could come under renewed pressure.

Outlook

With both geopolitical instability and macroeconomic uncertainty in play, traders expect continued volatility in gold prices in the short term. The metal's near-term direction will likely hinge on outcomes from the Fed meeting and developments in the Middle East.

4 hours ago

1

4 hours ago

1

English (US) ·

English (US) ·