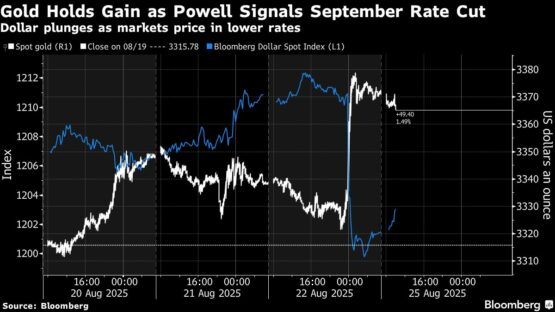

Gold held an advance as the momentum for US interest-rate cuts grew, after Federal Reserve Chair Jerome Powell opened the door to a reduction in September.

Bullion traded near $3,370 an ounce, following a 1.1% gain on Friday when Powell used his keynote speech at the Jackson Hole symposium to point to rising risks for the labour market — even as worries over inflation remain. Policy-sensitive two-year Treasury yields tumbled, while a gauge of dollar strength fell after the comments, adding support for gold as it doesn’t pay interest and is priced in the US currency.

ADVERTISEMENT

CONTINUE READING BELOW

Swap traders now see a more than 85% chance the Fed will reduce rates next month. There’s still a high degree of uncertainty over the outlook beyond September, as US inflation remains above target and the jobs market shows signs of weakness.

Powell noted the economy has handed Fed officials a “challenging situation,” and underscored that questions remained over whether President Donald Trump’s tariffs will reignite inflation in a more persistent way. He also called the labour market’s current status “curious.”

Gold has climbed by more than a quarter this year, with the bulk of those gains occurring in the first four months, supported by heightened geopolitical and trade tensions that have spurred haven demand, along with central bank purchases. Some market watchers, including the wealth management unit of UBS Group AG, anticipate more upside for the precious metal.

Still, hedge funds have cut their bullish gold positions to a six-week low, according to the latest Commodity Futures Trading Commission data.

Spot gold was down 0.1% to $3 369.59 an ounce at 7:52 a.m. in Singapore. The Bloomberg Dollar Spot Index added 0.1%. Silver and platinum were flat, while palladium edged up.

© 2025 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

12 hours ago

1

12 hours ago

1

English (US) ·

English (US) ·