The entry of Chinese motor manufacturers into the South African market in recent years has been nothing short of astonishing.

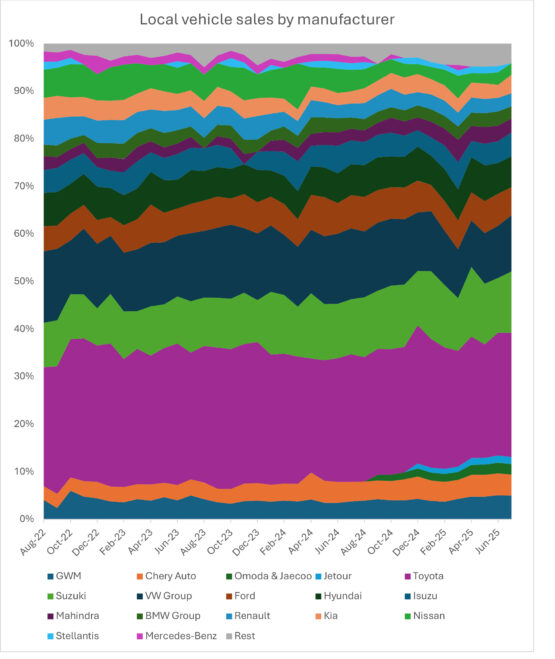

Data from the Automotive Business Council (Naamsa) shows four of these manufacturers are now in the 15 largest brands, when measured by local sales of vehicles.

Listen/read: The new generation of car buyers: What they want and why it matters

In July, GWM – which includes both the GWM and Haval brands – was sixth, with Chery Auto in eighth place. Omoda and Jaecoo are in 14th, while Jetour is 15th. The latter only launched in the country in September 2024 and Jaecoo launched earlier in the year.

Omoda entered the market in April 2023, while Chery, GWM, and Haval have been in the country for more than five years.

According to a Moneyweb analysis of Naamsa data, these manufacturers together now comprise more than 10% of all vehicles sold in the country. This includes passenger vehicles, light commercial vehicles (LCVs), minibus taxis, as well as trucks and buses.

Measured on only passenger cars and LCVs, these four manufacturers now account for 13% of local vehicle sales. Add in JAC and Baic (each selling around 200 units a month), and this increases further.

Read:

Tata re-enters SA passenger car market after six-year absence

Mahindra boosts South Africa capacity as budget car demand jumps

Chinese SUVs are ‘iPhone moment’ for rest of motor industry

ADVERTISEMENT

CONTINUE READING BELOW

Together, these four Chinese manufacturers sold over 6 000 units locally in June and July. A year ago, this was around the 3000-unit level. Data for Omoda, Jaecoo and Jetour was only available from December, as this is when the latter three brands entered Naamsa’s top 15 (at 655 for Omoda and Jaecoo and 420 for Jetour).

Prior to that (and since their entry), these makes would’ve been selling a few hundred vehicles a month.

Manufacturers Mercedes-Benz and Stellantis (which owns Alfa Romeo, Citroën, Fiat, Jeep, Opel and Peugeot) have both fallen out of the top 15 over the last year. These manufacturers are currently each selling between 400 and 600-ish vehicles a month. In the case of Stellantis, this is across all its brands in the country.

Merc has been in the top 15 consistently until about a year ago.

Three years ago, it was selling closer to 1 000 units a month. Jaguar Land Rover and Mazda are also solidly outside of the top 15 (each also selling around 200 units monthly), while Mitsubishi and Honda each sell around 150.

Source: Naamsa, Moneyweb analysis

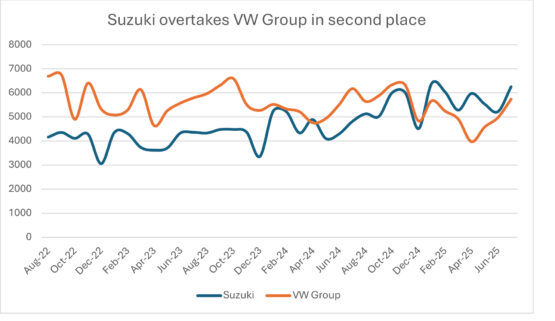

Of note is how Suzuki has now solidly eclipsed VW Group as the second-largest auto company in SA, based on unit sales. Sales of Suzukis first overtook VW in April 2024 (by just 133 units), before slipping back into third place for the remainder of the year.

ADVERTISEMENT:

CONTINUE READING BELOW

From January, however, Suzuki was back in second position, and it has remained there ever since.

Three years ago, sales of VW Group vehicles were often exceeding the 6 000-unit level. The last time it hit that mark was in October and November last year.

In April 2025, it sold fewer than 4 000 units (3 973), quite possibly the lowest in the last decade. Of note is that VW Group sales include both the Volkswagen and Audi brands. In April, Business Live reported that Audi would reduce the number of dealers in the country. It said it would “implement an “optimised footprint strategy that balances meaningful customer experiences with operational efficiency”.

This follows a similar decision by BMW to reduce its number of dealerships in South Africa.

Read/listen:

BMW SA ‘not exposed’ to current US tariff uncertainty

No spark for European car companies

New vehicle inflation plunges to lowest level in three years

According to Naamsa data, sales for the BMW Group have averaged around 1 250 a month so far this year, versus an average of 1 040 in 2024. As is the case with VW Group, these sales are across two brands: BMW and Mini.

Various reports have said that the premium vehicle segment in South Africa has shrunk to roughly a third of the size it was a decade ago. Sales in this segment last year were at its lowest level in over 10 years.

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

17 hours ago

1

17 hours ago

1

English (US) ·

English (US) ·