The South African Revenue Service (Sars) acknowledges that the country’s illicit cigarette trade has escalated into a “significant economic and enforcement challenge”.

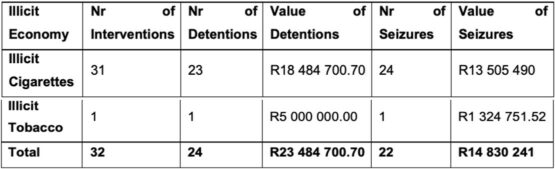

Current estimates suggest that up to 70% of cigarettes sold in the country are illicit, resulting in annual tax revenue losses exceeding R27 billion. However, in the past six months, Sars has seized illicit cigarettes to the value of R13.5 million and illicit tobacco to the value of R1.3 million.

ADVERTISEMENT

CONTINUE READING BELOW

“Despite the scale of this challenge, Sars has made significant strides in the tobacco sector (and several others), including the ongoing process of reviewing licensing requirements and conditions,” the agency said in response to questions about the impact of law enforcement actions on illicit trade.

Actions

Sars says it has been reviewing the licenses of repeat offenders and conducting focused financial investigations and audits to recover unpaid taxes. It recently secured a preservation order against several entities in KwaZulu-Natal following a R96 million investigation into suspicious financial transfers.

Moneyweb reported that cheap cigarettes, sometimes selling for around R5 per packet of 20 in the market, translate into an estimated R28 billion loss to the fiscus annually. This amounts to around R100 million each working day.

Read: Market for illicit cigarettes reaches record levels

Read/listen: Illicit tobacco trade costs SA R20bn annually

It has deployed a deliberate strategy to intercept and seize illicit cigarettes at entry points and conduct joint operations with law enforcement agencies.

“This ensures that Sars does not only focus on revenue recoveries but also removes illicit goods from circulation.”

The tax agency notes that illicit trade is not unique to cigarettes and tobacco. Valuation fraud within the textile, clothing and steel industries places enormous pressure on legitimate businesses, economic growth, job creation, and the tax base.

During 2024-2025, several arrests have been made, with cases currently at different stages of investigation and litigation. This includes a single prosecution concerning the illegal import, distribution, and sale of illicit cigarettes.

Successes

ADVERTISEMENT:

CONTINUE READING BELOW

In July this year, a company called Uptown Superstore Store was fined R600 000 after being convicted of dealing with counterfeit cigarettes. A total of 4 710 packets of illicit cigarettes, valued at R107 700, were seized from the business.

Over the past five years, Sars’s criminal investigation unit has handed 129 customs and excise cases to the National Prosecution Authority (NPA). There are currently 105 cases on the NPA roll, 33 of which are on trial, while 72 are pending the allocation of a trial date. Eight of these cases relate to illicit cigarettes and tobacco, four of which are on trial, and four are awaiting the allocation of a trial date. More than 30 customs and excise cases have resulted in successful convictions.

Challenges

Some of the actions include technological surveillance initiatives such as CCTV monitoring, which requires the installation of cameras at tobacco manufacturing facilities to monitor production and prevent tax evasion. However, this initiative has been delayed due to legal challenges brought by some of the industry players.

Bozza Tobacco and the Fair-Trade Independent Tobacco Association (Fita), representing several smaller tobacco producers, secured an interim interdict preventing Sars from attempting to install cameras in tobacco facilities. Sars subsequently lost its appeal against the ruling.

Read: Sars loses its appeal to install cameras in tobacco factories

The revenue authority says engagements with industry experts have provided it with access to updated intelligence on illicit manufacturing trends and distribution networks. Technical insights into product authentication, traceability, and packaging forensics are supplied on a continuous basis.

Sars has specifically established a syndicated tax and customs crimes investigations division to probe criminal and syndicated evasion schemes across all taxes. The division continues to investigate cases pertaining to tax non-compliance, smuggling, diversion, ghost exports, and misdeclaration in high-risk industries, including the tobacco and cigarettes industry.

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

1 week ago

5

1 week ago

5

English (US) ·

English (US) ·