Collaboration between the public and private sectors, beyond just insurance, is essential to narrowing the so-called protection gap, as losses from natural disasters increase, said the head of a global insurance supervisors’ group.

The protection gap refers to the difference between economic losses caused by an event such as a hurricane, drought or massive flood and the amount of those losses that are covered by insurance.

ADVERTISEMENT

CONTINUE READING BELOW

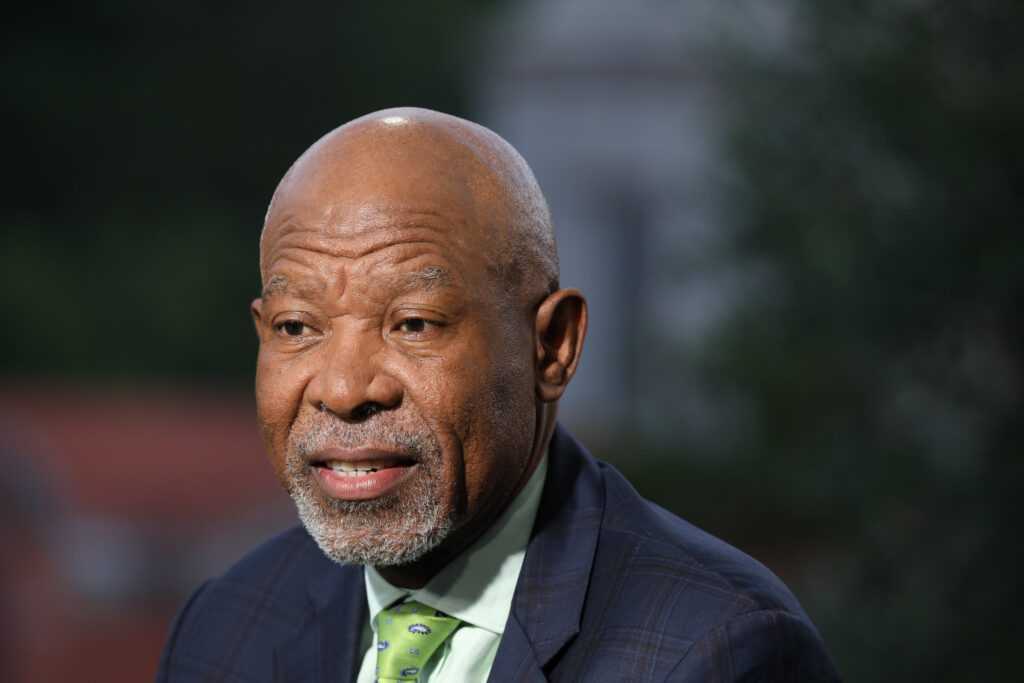

“With the protection gap expanding rapidly, it’s becoming hard to fully address the issue through insurance-based solutions alone,” said Shigeru Ariizumi, chair of the International Association of Insurance Supervisors, in an interview with Bloomberg on Wednesday.

Insured losses from natural catastrophes may reach $145 billion this year — well above the 10-year average — as population growth, urban sprawl and climate change combine to supercharge risks, according to an estimate in April from the Swiss Re Institute.

The rising costs make it essential that the insurance industry “reach out not only to regulators and supervisors, but also to broader policymakers, government departments outside of insurance, academia, and even customers to work together and figure out how to tackle this issue,” Ariizumi said.

Ariizumi spoke near Durban, South Africa, ahead of a panel focused on the protection gap on Thursday. The event, held alongside the G20 finance chiefs’ meetings, was attended by World Bank President Ajay Banga and the chair of French insurer Axa SA.

To address losses from natural disasters, Ariizumi said various forms of collaboration are possible such as the public sector agreeing to take on part of the risk when an event is deemed too great for private financial institutions to handle the costs on their own.

The IAIS chair also called for regulators to promote the development of alternative options such as parametric insurance, where policyholders get payouts when pre-defined disaster-related metrics are met, and also catastrophe bonds.

“It’s becoming increasingly difficult for insurance companies to take on certain risks, and in some countries, insurance availability and affordability are emerging as serious concerns,” Ariizumi said.

ADVERTISEMENT:

CONTINUE READING BELOW

If the insurance sector can transfer some of these risks, then public markets offer a viable solution, he added, emphasising the importance of thorough, clear disclosures for bond investors.

The market for catastrophe bonds, which are typically issued by insurers looking to offload extreme risk to capital markets, is forecast to expand by 20% and reach $60 billion by the end of 2025, according to hedge fund Fermat Capital Management.

After this week’s meetings in South Africa, a report is expected to be released that will outline the challenges and possibilities of cross-sector collaborations. The paper will include examples of potential solutions that can be adapted by each country based on their risk exposure, fiscal conditions and other factors.

At recent G20 gatherings, countries including Brazil and South Africa have pushed for climate support from more developed economies. It’s questionable how the US might participate given President Donald Trump’s efforts to scale back the country’s involvement in climate-related initiatives such as the Paris Agreement and the Just Energy Transition Partnerships. At the same time, the US has been hammered this year by wildfires in California and deadly floods in Texas.

“The expanding protection gap is a global challenge that includes emerging countries, as well as advanced economies,” Ariizumi said. “Since it’s a global issue, I believe the response must be global as well.”

© 2025 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

15 hours ago

1

15 hours ago

1

English (US) ·

English (US) ·