- JPMorgan forecasts the S&P 500 will reach 7,000 by early 2026 due to strong corporate spending and AI-driven growth. Both JPMorgan and Piper Sandler say the new corporate expensing laws in President Trump’s OBBBA, and AI investment, are key drivers. That’s how stocks are climbing a “wall of worry” despite war and chaos in Eastern Europe and the Middle East.

It’s bad out there. Russia is flying bombs over Poland, shutting down its airports. Israel conducted a missile strike on Hamas in Doha, even though Qatar is a Western ally. And the U.S. government revised down its employment numbers, revealing there are nearly 1 million fewer jobs in the economy than previously thought. And don’t forget the trade war.

So, obviously, S&P 500 futures are up 0.25% this morning and the underlying index closed at yet another record high yesterday, up 0.27% at 6,512.61.

Stock investors love trouble, it seems!

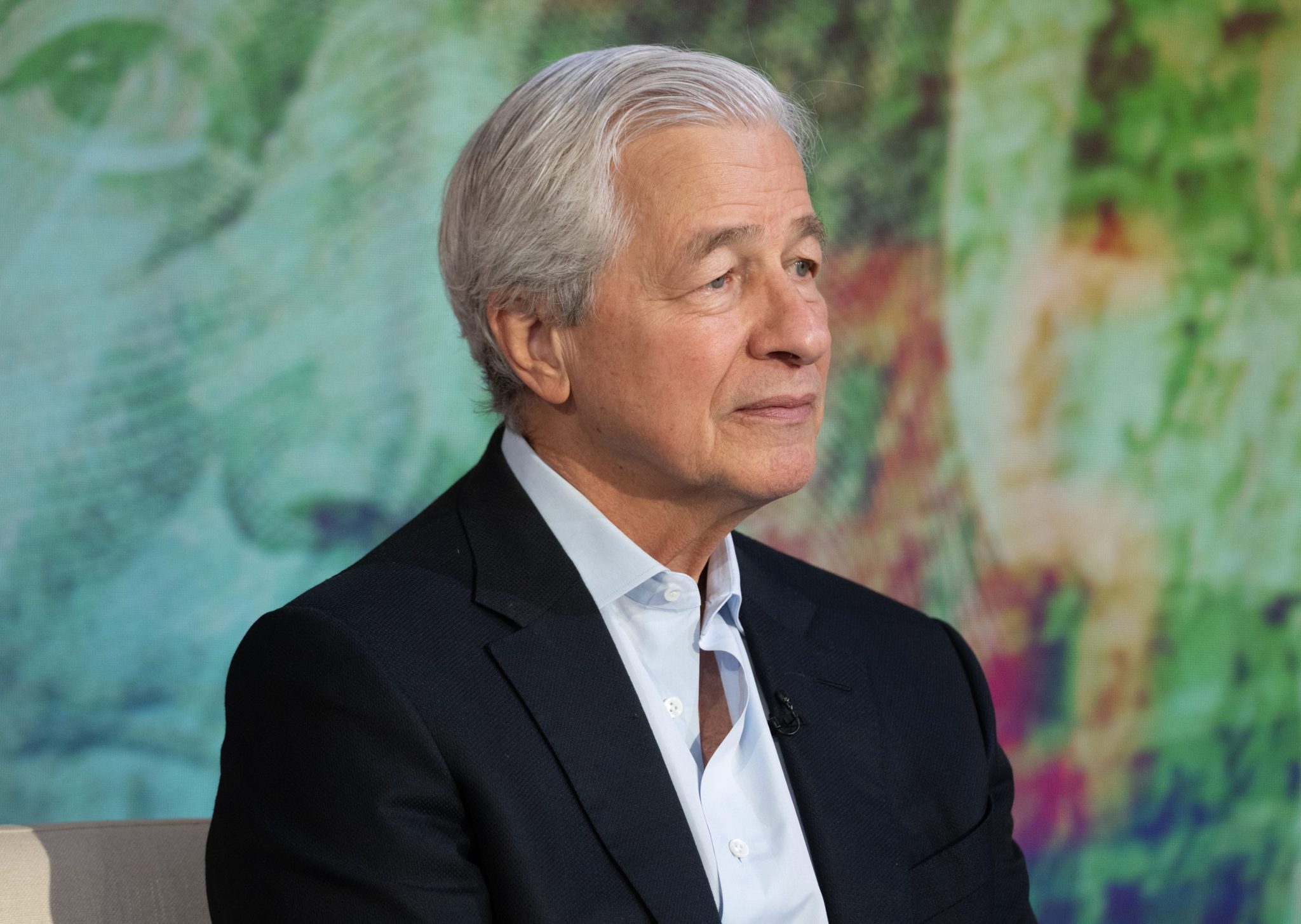

“S&P 500 has delivered a 31% gain since the April 9th lows, the best 5 month performance in roughly two decades outside of a recession,” according to JPMorgan’s Dubravko Lakos-Bujas.

What’s happening is that stocks are climbing “the wall of worry,” he told clients in a note this morning. The wall of worry is a cliché that describes the notion that investors like hearing bad news because they can price it in and leave it in the rearview mirror—investing is about what you think will happen in the future, not what happened in the past.

Thus Lakos-Bujas has a new target for the S&P: 7,000. But the climb upward will be rocky, he says: “Short-term caution (S&P 500 downside to 6,000-6,200); medium-term further upside (7,000 by early 2026).”

He’s not alone. Piper Sandler’s Nancy Lazar has been talking about the wall of worry for weeks. “Yes, that’s a cliché, but it sure describes today’s eco environment,” she told clients last month.

Both agree broadly on what is driving stocks upward. AI, increased capital expenditure by companies, and a weak dollar. They both point to President Trump’s One Big Beautiful Bill” for driving the growth in capex. It contained provisions which allow companies to immediately deduct spending on equipment, machinery, and R&D. This has opened the floodgates to corporate spending. “The OBBBA’s frontloading of spending should help offset some of the growth headwinds tied to tariffs and immigration,” the JPMorgan analyst said in a note seen by Fortune.

The capex wave is “not limited to the AI boom,” Piper’s Lazar said. It’s “increasingly driven by the new tax law’s instant expensing. … Capex and employment swing together .. so as investment gathers steam, eventually so will jobs,” she told clients in August.

Here’s a snapshot of the markets globally this morning:

- S&P 500 futures were up 0.26% this morning. The index closed up 0.27% in its last trading session.

- STOXX Europe 600 was up 0.49% in early trading.

- The U.K.’s FTSE 100 was up 0.5% in early trading.

- Japan’s Nikkei 225 was up 0.87%.

- China’s CSI 300 was up 0.21%.

- The South Korea KOSPI was up 1.67%.

- India’s Nifty 50 was up 0.42% before the end of the session.

- Bitcoin rose to $112.6K.

This story was originally featured on Fortune.com

3 hours ago

1

3 hours ago

1

English (US) ·

English (US) ·