Tech Mahindra reported a strong set of numbers for the first quarter of FY26, with net profit jumping 34 per cent year-on-year (YoY) to Rs 1,141 crore, driven by better-than-expected margins and strong deal wins. Revenue for the quarter rose 3 per cent YoY to Rs 13,351 crore, while earnings per share (EPS) stood at nearly Rs 13.

The company secured new deal wins worth $809 million, a 51 per cent increase from $534 million in Q1FY25. Tech Mahindra’s $50 million+ client count rose 2 per cent YoY to 26.

However, revenue declined 1 per cent YoY in constant currency (CC) terms, and USD revenue grew just 0.4 per cent YoY to $1,564 million, reflecting subdued topline momentum despite the strong order book.

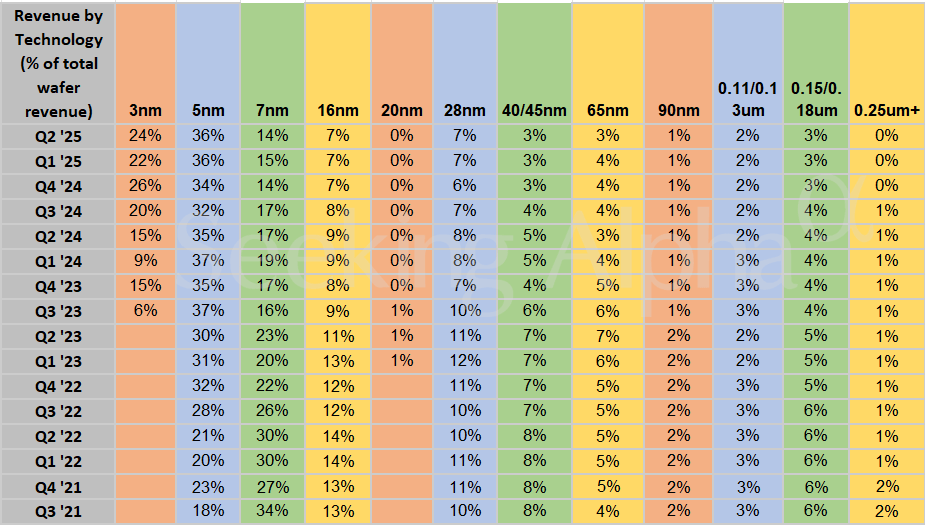

Key Financial Highlights of Tech Mahindra – Q1 FY26

Net profit: Rs 1,141 crore (+34 per cent YoY)

Revenue: Rs 13,351 crore (+3 per cent YoY)

EPS: Nearly Rs 13

Deal wins: $809 million (+51 per cent YoY)

USD revenue: $1,564 million (+0.4 per cent YoY)

Revenue in CC terms: -1 per cent YoY

$50M+ clients: 26 (+2 per cent YoY)

What Brokerages Say: Buy, Sell or Hold Tech Mahindra?

Jefferies

Rating: Underperform

Target: Rs 1,400 (cut from Rs 1,430)

Revenue miss despite margin beat; 15 per cent margin goal by FY27 seen as ambitious given cost pressures

Morgan Stanley

Rating: Underweight

Target: Rs 1,555 (cut from Rs 1,575)

Positive on margins and client stability but cautious on deal conversion and macro risks

CLSA

Rating: Buy

Target: Rs 2,020 (cut from Rs 2,123)

EBIT in line; slower revenue offset by strong margins and deal wins; expects growth to resume from Q2

Nomura

Rating: Buy

Target: Rs 1,810 (cut from Rs 1,840)

Mixed quarter; business repair ongoing; raises FY26–27 EPS by 1–2 per cent

Citi

Rating: Sell

Target: Rs 1,400 (cut from Rs 1,430)

Notes sharper-than-expected revenue fall; expects flat CC revenue in FY26

JP Morgan

Rating: Neutral

Target: Rs 1,550

HSBC

Rating: Buy

Target: Rs 1,900

Says Q1 is aligned with FY27 roadmap but margin improvement delays remain a key risk

Macquarie

Rating: Underperform

Target: Rs 1,110

Believes growth and margin targets are difficult to meet; continues to lag peers in key verticals

Market Guru Anil Singhvi’s Take on Tech Mahindra Results

Anil Singhvi, Managing Editor of Zee Business, called Tech Mahindra’s Q1 “the best in the IT sector this earnings season.”

He highlighted:

Consecutive seventh quarter of margin expansion

44 per cent YoY jump in deal wins

No EPS downgrade, unlike TCS and HCL Tech

The company’s conscious choice to focus on profitability over growth

Anil Singhvi’s Trading View:

Buy Tech Mahindra Futures

Stop Loss: Rs 1,580

Targets: Rs 1,625 / Rs 1,640 / Rs 1,655

"These results signal that IT stocks could be bottoming out, with Tech Mahindra leading the trend," he said.

4 hours ago

1

4 hours ago

1

English (US) ·

English (US) ·