| CPI MoM | +0.3% | +0.3% |

| Core CPI MoM | +0.2% | +0.3% |

| CPI YoY | +2.7% | +2.6% |

| Core CPI YoY | +2.9% | +2.9% |

Goods prices, excluding food and energy commodities, rose 0.2% after stalling in the prior month. Categories that are more exposed to tariffs, including toys, furniture, appliances and apparel, showed strength, suggesting companies are starting to pass higher import costs on to consumers. Meantime, prices of new and used cars declined.

ADVERTISEMENT

CONTINUE READING BELOW

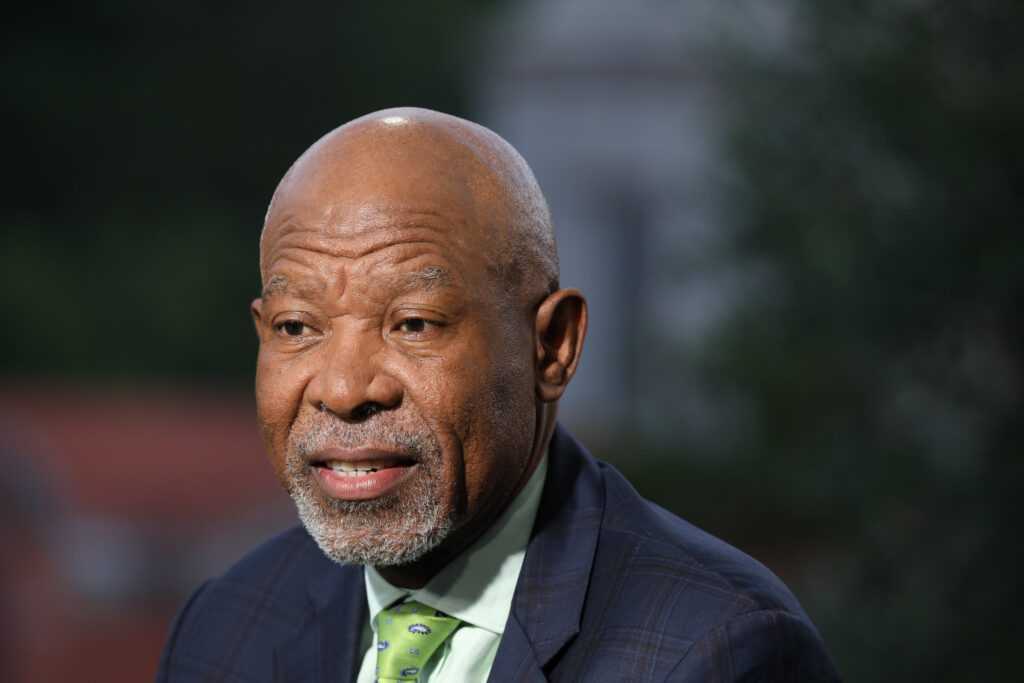

Inflation Insights LLC President Omair Sharif pointed out that excluding cars, core goods prices climbed 0.55% in June — the biggest monthly advance since November 2021. “Today’s report showed that tariffs are beginning to bite,” he said in a note.

However, the slew of below-forecast inflation readings raises questions as to how broadly President Donald Trump’s tariffs will impact consumer prices. Some companies have been able to shield customers by stocking up on inventories ahead of the levies or absorbing part of the higher costs at the expense of lower margins.

The weaker-than-expected number could draw even greater calls from Trump for the Federal Reserve to lower interest rates. While some officials have expressed willingness to cut rates when the central bank meets in two weeks, policymakers generally are still divided as to whether tariffs will cause a one-time price shock or something more persistent and will probably leave rates unchanged for now.

“While any tariff induced boost to inflation is likely to be short-lived, with higher tariffs being announced it would be wise for the Fed to remain on the sidelines for a few more months at least,” Seema Shah, chief global strategist at Principal Asset Management, said in a note.

Stock futures remained higher, Treasury yields fluctuated and the dollar was lower after the report.

Services costs

Services prices excluding energy climbed 0.3%. Within services, one of the key drivers of inflation in recent years has been its largest category: housing. Shelter prices decelerated, dragged down by lower hotel prices.

Another services gauge closely tracked by the Fed, which strips out housing and energy costs, picked up to 0.2%, including a big gain in hospital services. While central bankers have stressed the importance of looking at such a metric when assessing the overall inflation trajectory, they compute it based on a separate index.

ADVERTISEMENT:

CONTINUE READING BELOW

That measure — known as the personal consumption expenditures price index — doesn’t put as much weight on shelter as the CPI, which helps explain why it’s trending closer to the Fed’s 2% target. A government report on producer prices due Wednesday will offer insights on additional categories that feed directly into the PCE, which is scheduled for later this month.

Part of the reason why some companies see price hikes as a last resort is that they fear consumers, who have grown more pessimistic on the economy this year, will only tolerate so much and eventually spend less — which economists will be looking for in a report Thursday on retail sales. Still, firms like Nike Inc. and Dollar General Corp. have recently said they’re planning to raise prices.

A lot of companies have been able to hold out for now since the deadline on Trump’s most punitive levies keeps getting pushed back — with early August now the target, nearly a month later than expected. But in the past week, Trump has ramped up his tariff threats on copper as well as those on Canada, Mexico and other countries, and said he wouldn’t extend the timeline again. Some discussions are underway to strike deals before then.

Central bankers also pay close attention to wage growth, as it can help inform expectations for consumer spending — the main engine of the economy. A separate report Tuesday that combines the inflation figures with recent wage data showed that real average hourly earnings decelerated to a 1% pace from the year before, the weakest since the start of 2025.

© 2025 Bloomberg

1 day ago

2

1 day ago

2

English (US) ·

English (US) ·